Learn how the new 5% GST Rate on essential items in 2025 affects Indian households. Explore HSN codes 2025, GST on daily items, and how to use an easy GST calculator for low GST products.

In 2025, the Government of India has taken a very important step to make life easier for the common people. They have made a decision to put a 5% GST rate on essential goods. This decision is not only good for the pockets of the aam aadmi (common man) but also makes tax collection simpler. With new HSN codes 2025, people can now easily identify which goods are under this low GST slab.

This article explains everything in a simple and friendly way. We will talk about GST basics 2025, GST on daily items, and how these changes will benefit you. We will also explain how to use an Easy GST Calculator, how consumer tax benefits work, and what the retail GST update means for shopkeepers and customers.

What Are Essential Goods Under GST and Why 5% Rate Matters?

Essential goods are items that every household needs to live a basic life. These include things like food grains (rice, wheat, dal), milk, cooking oil, soap, toothpaste, and basic medicines. In 2025, the government has fixed a 5% GST rate for these products to keep them affordable for everyone.

Earlier, different products had different tax rates. This confused people and made goods expensive. Now, with a flat 5% GST rate on low GST products, it is easier for consumers and shopkeepers. The aim is to support consumer finance GST benefits by lowering prices on necessary items. This is especially helpful for middle-class and poor families.

This change also helps in better implementation of GST for necessities, so there is no confusion about the tax rates. With the help of HSN codes 2025, both sellers and buyers can clearly know what falls under the 5% category.

GST Basics 2025: What Every Consumer Should Know

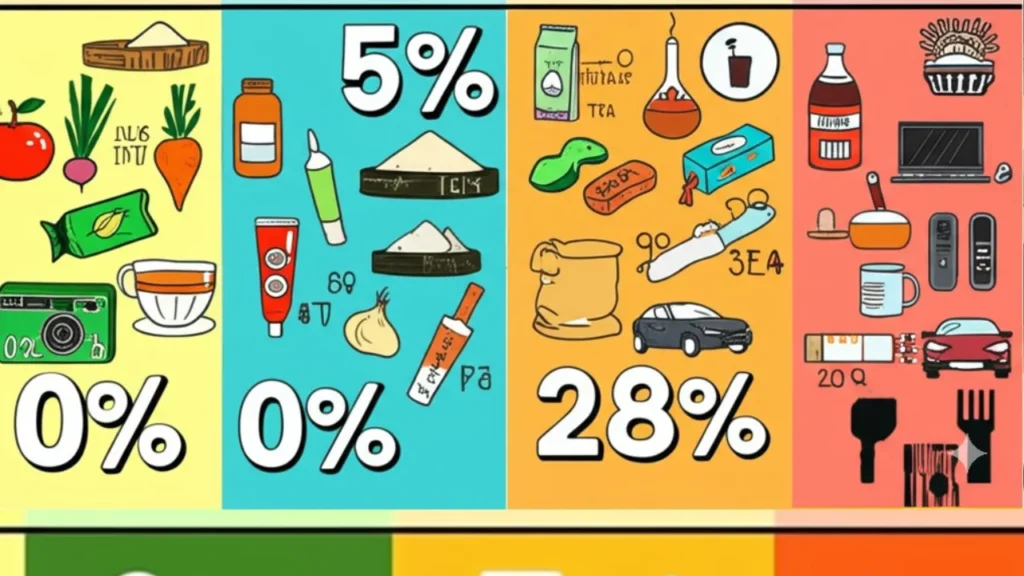

Let us understand the basic idea of GST in 2025. GST means Goods and Services Tax. It is a single tax system used across India. Instead of paying different taxes like VAT, excise duty, and service tax, now you only pay GST. It is divided into four major slabs – 0%, 5%, 12%, 18%, and 28%. The 5% GST slab is mostly for essential goods.

Under the new GST basics 2025, products are assigned an HSN code. HSN codes 2025 stand for Harmonized System of Nomenclature – a system used to classify products. These codes make it easy to understand which tax rate applies to which product. For example, the HSN code for rice is different from the one for shampoo.

Also, the Easy GST Calculator helps both consumers and small shopkeepers quickly find out how much tax to add or pay on a product.

GST Rates and Their Purpose in 2025

| GST Slab | Type of Products | Examples |

|---|---|---|

| 0% | Tax-free essentials | Fresh vegetables, eggs |

| 5% | Daily use items (low GST) | Rice, atta, milk, soap |

| 12% | Slightly processed goods | Toothpaste, tea, garments |

| 18% | Services & regular goods | Mobiles, appliances |

| 28% | Luxury or sin products | Cigarettes, cars |

The Role of HSN Codes 2025 in Identifying GST on Daily Items

HSN codes 2025 play a big role in knowing how much GST to pay. Each product has a unique code that helps identify the right GST rate. For example, HSN Code 1006 is for rice, which falls under the 5% GST slab.

The new update in HSN codes for 2025 makes classification better and reduces errors. Sellers must print the HSN code and the GST rate on the bill so that buyers can clearly see the taxes. This is especially useful for shopkeepers and wholesalers. It also reduces chances of overcharging.

Consumers can now use Easy GST Calculator apps that let them enter the HSN code and price, and the app will show how much tax is included.

Consumer Tax Benefits of 5% GST on Essentials

Putting a low GST rate of 5% on GST for necessities helps Indian consumers save money. Earlier, some essential items had higher tax rates or were taxed under multiple categories. Now, the reduced rate gives clear consumer tax benefits like:

- Lower prices on grocery items

- Transparent billing with HSN codes

- No hidden charges in retail stores

- Higher savings for middle-class families

This affordable GST rate also encourages consumers to buy from formal shops instead of unregistered sellers. This improves the overall economy as more shops follow rules and pay tax.

Retail GST Update in 2025

Retailers in India have also seen a big change with this retail GST update. Now, it is mandatory for them to show HSN codes and GST rates on bills for essential items. This ensures transparency and trust among customers.

Smaller retailers and kirana stores can use Easy GST Calculator apps or POS machines to auto-calculate the GST. Many such calculators are now available in regional languages, making it easy for everyone.

The government has also announced training programs for small retailers on how to apply correct GST and use HSN codes 2025. This way, both buyer and seller benefit from correct and simple GST practices.

GST for Necessities

The following are common daily-use items that fall under the 5% GST essentials category in 2025:

- Rice and wheat

- Pulses (dal)

- Cooking oil

- Milk and curd

- Tea and coffee (unprocessed)

- Soaps and detergents

- Toothpaste and basic hygiene items

- Sanitary pads

- Kerosene and LPG

These low GST products are listed under specific HSN codes 2025, making it easy to identify them in shops or on websites.

Example:

- Rice: HSN Code 1006 – 5% GST

- Cooking Oil: HSN Code 1512 – 5% GST

- Detergent: HSN Code 3402 – 5% GST

Affordable GST Rate

Thanks to the affordable GST rate of 5% on essential goods, Indian families are seeing actual savings in their monthly spending. Let’s take an example:

Before 2025: Monthly grocery bill – ₹8,000 (with multiple taxes) After 5% GST Rule: Monthly grocery bill – ₹7,500 (with GST) Savings: ₹500 per month or ₹6,000 per year

This is a major relief for people dealing with inflation. Plus, when people save more, they spend more on education, health, and investments, improving overall consumer finance health.

Easy GST Calculator: A Helpful Tool for Every Household

An Easy GST Calculator is now available in mobile apps, websites, and even some physical devices used in retail shops. These tools are helpful for:

- Calculating GST on items by entering HSN code and price

- Avoiding overcharging by checking correct GST

- Educating kids and family members about daily spending

Some popular Easy GST Calculator apps in 2025 are:

- Bharat GST App

- GST Sahayak

- RetailMitra

All these tools are free to use and support regional languages too.

Conclusion

In 2025, the Indian government has taken a people-friendly step by putting 5% GST on essential goods. Thanks to updated HSN codes 2025, it is now simple for everyone to know the correct tax rate. Whether you are a consumer or a shopkeeper, tools like the Easy GST Calculator help you save time and money.

This move ensures more transparency, boosts savings, and makes life easier for Indian households. It promotes the idea of a fair and affordable tax system that everyone can understand and benefit from.

So next time you go shopping, don’t forget to check the bill for the HSN code and 5% GST rate. It’s your right and also your way to save money!

FAQ of 5% GST Essentials in 2025

What is the GST rate for rice in 2025?

Rice has a 5% GST rate under HSN Code 1006.

Which daily items come under 5% GST essentials?

Items like milk, dal, cooking oil, soap, and toothpaste.

How do HSN codes help in identifying GST?

HSN codes classify products, making it easy to know the GST rate

What is the Easy GST Calculator?

A tool that helps calculate GST using HSN code and price.

How much can a family save due to 5% GST?

A family can save ₹500 per month or more.

Where can I find the HSN codes 2025?

On the official GST website or Easy GST Calculator apps.

Do shopkeepers have to show GST on bills?

Yes, it is mandatory to show HSN code and GST rate on the bill.

Is 5% GST better than previous tax systems?

Yes, it is simpler and cheaper for essential goods.

Can I use GST calculator in Hindi?

Yes, most apps support Hindi and other regional languages.

Will GST on essentials change again?

It may, but for now in 2025, the 5% rate is fixed for essentials.