Stuck with an old email on the GST portal? Here is the step-by-step 2025 guide How to Change Email ID in GST Portal? Avoid penalties & stay compliant. Click now!

Did you know that using an outdated email ID on the GST portal can lead to missed notices, penalties, or even suspension of your GSTIN? With the latest 2025 updates, the GST portal has made it easier than ever to update your email ID—but only if you know the right steps! Whether you’re a small business owner, a CA, or a taxpayer, this guide will walk you through the process like a pro. Let’s dive in!

How to Change Email ID in GST Portal in 2025

Case 1: When the Authorized Signatory is the Same

Watch Practical Video

Just follow this simple steps to Change Email ID in GST Portal

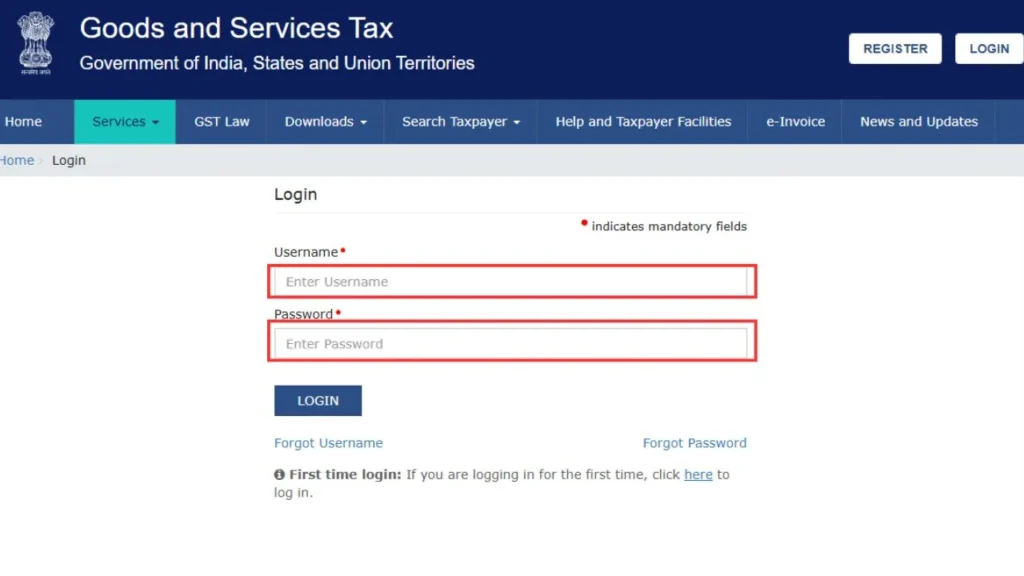

Step 1: Log in to the GST Portal

- Visit www.gst.gov.in.

- Enter your username, password, and captcha.

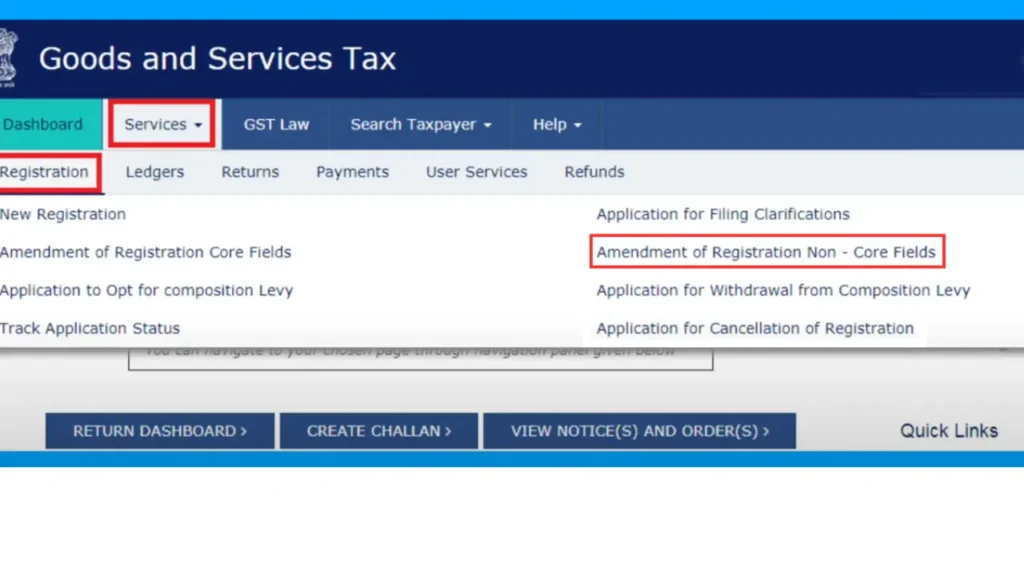

Step 2: Navigate to ‘Amendment of Registration Non-core Fields’

- Go to Services > Registration > Amendment of Registration Non-core Fields.

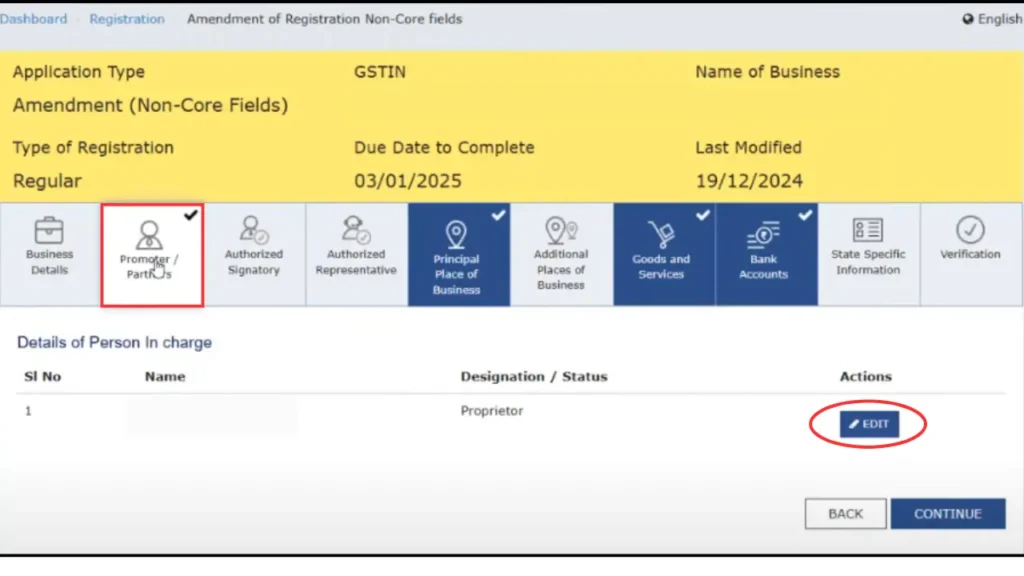

Step 3: Edit Promoter/Partner Details

- Click the ‘Promoter/Partners’ tab.

- Hit ‘Edit’ next to the authorised signatory.

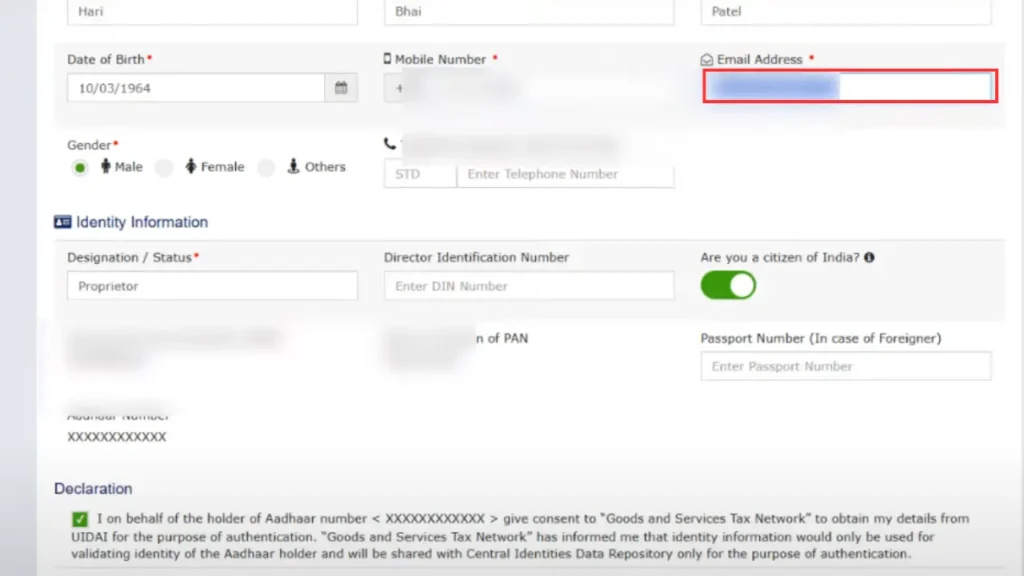

Step 4: Update Email ID & Mobile Number

- Enter the new email ID and mobile number.

- Click ‘Save’.

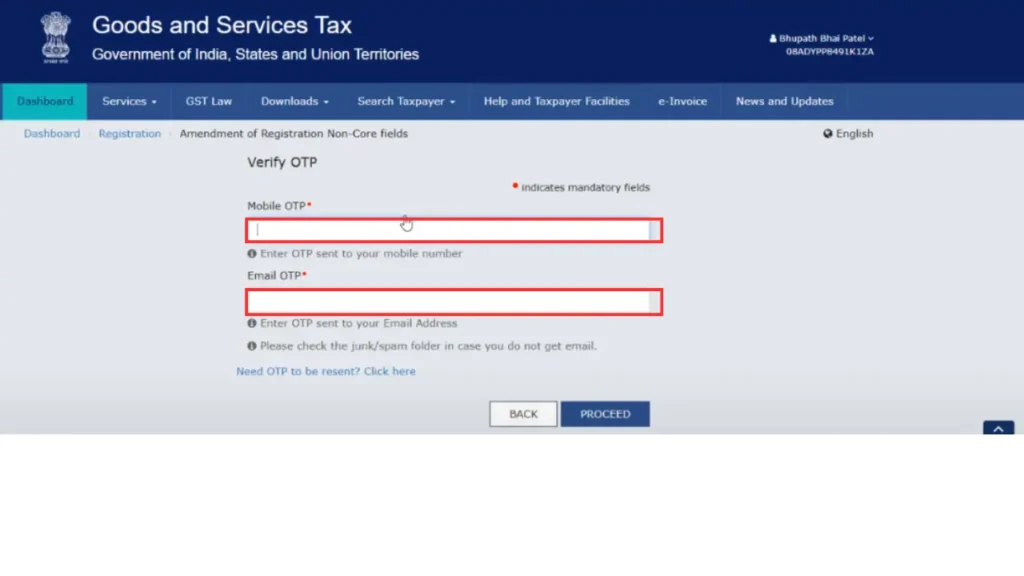

Step 5: Verify via OTP

- An OTP will be sent to the new email and mobile.

- Enter both OTPs to proceed.

Step 6: Submit with DSC/E-Signature/EVC

- Go to the ‘Verification’ tab.

- Choose verification mode (DSC, E-signature, or EVC).

- If using EVC, an OTP is sent to the updated mobile number.

Step 7: Confirmation

- You’ll receive an ARN (Application Reference Number) to track your request.

- Once approved, a ‘Changes Approved’ message appears.

Try Our Free Online GST Tools

Case 2: When the Authorized Signatory is Different

If you want to Change Email ID in GST Portal with Authorized Signatory is Different then here is the step by step guide.

Step 1: Add a New Authorized Signatory

- Under ‘Authorised Signatory’ tab, click ‘Add New’.

- Fill in the new signatory’s details (name, mobile, email).

Step 2: Set as Primary Signatory

- After 15 minutes, return to the ‘Authorised Signatory’ tab.

- Deselect the old signatory and mark the new one as ‘Primary’.

Step 3: Verify New Contact Details

- OTPs are sent to the new email and mobile.

- Complete verification.

Pro Tip: Always cross-check the new signatory’s PAN and Aadhaar details to avoid rejection!

Why Updating Your Email ID in GST Portal is Crucial in 2025

The GST portal uses your registered email and mobile number for:

- Sending OTPs for login or filing returns.

- Notifying about GST dues, deadlines, or compliance alerts.

- Sharing important updates from the tax department.

In 2025, the government introduced stricter rules for non-compliance. If your contact details are outdated, you might miss critical updates and face legal hassles.

Common Mistakes to Avoid

- Incorrect OTP Entry: Double-check OTPs from email/SMS.

- Using Unregistered Mobile Numbers: Ensure the new number is linked to Aadhaar.

- Skipping the ARN: Track your application status using the ARN.

How an Easy GST Calculator Simplifies Compliance

Updating your email ensures you receive timely reminders for GST payments. Pair this with an easy GST calculator (like Cleartax or Groww) to:

- Automate tax calculations.

- Avoid manual errors.

- Get due-date alerts directly to your inbox!

Try Our Free Online GST Tools

Core vs. Non-Core Amendments in GST Portal

| Core Amendments | Non-Core Amendments |

|---|---|

| Change in business name | Update email ID/mobile number |

| Change in business address | Edit bank account details |

| Adding new business vertical | Modify authorised signatory |

| Requires approval from officer | Instant approval post-OTP |

FAQs

How long does it take to update the email ID?

Usually 15–30 minutes if OTPs are verified. Approval takes 1–2 working days.

What if I don’t receive the OTP?

Check spam folders. If issues persist, contact GST helpdesk (helpdesk@gst.gov.in).

Can I change the email without a mobile number?

No! Both email and mobile are updated together for security.

Is DSC mandatory for verification?

No. You can use EVC (OTP) or E-signature too.

What happens if my GST portal email is outdated?

You might miss compliance notices, leading to penalties.

Can a CA update the email on my behalf?

Yes! They need your authorization via GST portal’s ‘Authorized Representative’ section.

How many times can I change my email ID?

No limit, but frequent changes may trigger scrutiny.

Do I need to submit documents for email change?

No documents are needed for non-core amendments.

What’s the fee for updating email ID?

₹0! It’s free of cost.

Can I use the same email for multiple GSTINs?

Yes, but ensure each GSTIN has a unique mobile number.

Conclusion

Updating your email ID on the GST portal might seem like a small task, but in 2025, it’s a critical step to safeguard your business from penalties, missed deadlines, and compliance nightmares. Think of it as renewing your business’s lifeline—without it, you’re invisible to the tax department’s updates, refund alerts, and OTPs. By following the step-by-step guide of How to Change Email ID in GST Portal you’re not just changing an email; you’re ensuring:

- Zero Penalties: Avoid ₹10,000–50,000 fines for missed notices.

- Smooth Refunds: Receive timely alerts about refund approvals.

- Real-Time Compliance: Stay updated on GST rule changes (like the new 2025 e-invoice thresholds).

Pairing your updated email with an easy GST calculator is like having a superhero sidekick. These tools automate tax calculations, flag filing errors, and send deadline reminders straight to your inbox. For example, if you’re a Mumbai-based textile trader, a GST calculator can instantly compute IGST for interstate sales, saving you hours of manual work.