Confused about GST on cement in 2025? Learn the latest cement GST rate in India, HSN codes, brand-specific taxes (Ultratech, Ambuja, Birla), and tips to save money. Read now

Cement is the backbone of India’s construction boom. But did you know the GST rate on cement can make or break your budget? Whether you’re building a home, renovating, or just curious, this 2025 guide breaks down everything about cement GST rate, including updates, HSN codes, brand-specific taxes, and hidden tips to save money. Let’s dive in!

Cement GST Rate in India 2025

In 2025, the cement GST rate in India remains at 28% for most categories. However, exceptions apply for specific types like white cement or Portland cement. Here’s a quick table:

| Cement Type | GST Rate (2025) | HSN Code |

|---|---|---|

| Ordinary Portland Cement (OPC) | 28% | 2523 |

| White Cement | 18% | 2523 |

| Portland Pozzolana Cement (PPC) | 28% | 2523 |

| Black Cement | 28% | 2523 |

Try Our Free Online GST Tools

Why is Cement GST So High?

Cement is taxed at 28% because it’s classified as a “luxury” item. Critics argue this slows affordable housing, but the government hasn’t lowered rates in 2025. Builders often pass this tax to buyers, raising property prices.

White Cement GST Rate: Why is it Cheaper?

White cement GST rate is 18%, lower than regular grey cement. Why? It’s used for decorative purposes (e.g., tiles, artworks) and isn’t considered essential for basic construction. Brands like Birla White Cement benefit from this slab.

HSN Codes for Cement

All cement types fall under HSN code 2523. Whether it’s OPC cement GST rate or black cement GST rate, the code remains the same. Always mention this code in invoices to avoid legal issues.

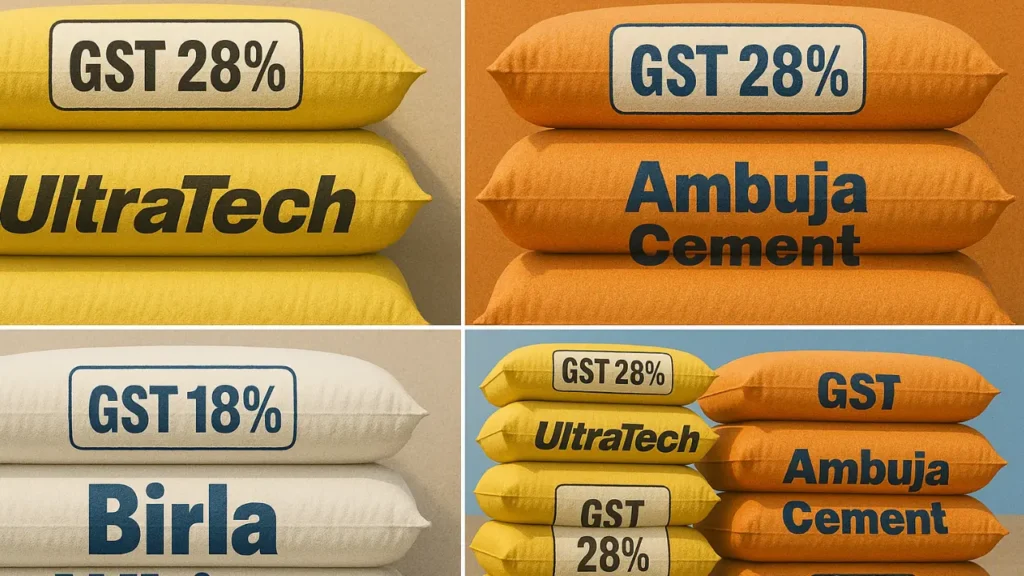

Brand-Specific GST Rates of Cement

1. Ultratech Cement GST Rate

Ultratech, India’s largest cement producer, follows the standard 28% GST. Their PPC and OPC varieties are taxed equally.

2. Ambuja Cement GST Rate

Ambuja Cement also charges 28% GST. However, their bulk discounts can offset tax costs for large projects.

3. Birla White Cement GST Rate

As mentioned earlier, Birla White Cement enjoys an 18% GST rate due to its decorative use.

Will Cement GST Rate Drop in 2025?

Despite industry demands, the 2025 Union Budget kept cement GST at 28%. Experts say a reduction is unlikely unless the government reclassifies cement as an “essential” item.

How to Save Money on Cement GST

- Buy in bulk to negotiate discounts.

- Use white cement for non-structural work (18% GST).

- Claim Input Tax Credit (ITC) if you’re a registered business.

Cement GST Rate vs. State Taxes

GST replaced state taxes, but check local levies like transportation fees. For example, Maharashtra adds a 5% cess on cement transportation.

Also Read

Future of Cement GST

Economists suggest GST on cement might drop to 18% by 2030 if housing demands rise. For now, plan your budgets with the 28% rate.

FAQs: Cement GST Rate 2025

1. What is the GST rate for OPC cement?

OPC cement GST rate is 28% under HSN code 2523.

2. Is white cement GST lower than grey cement?

Yes! White cement GST rate is 18%, while grey cement is taxed at 28%.

3. What’s the HSN code for black cement?

Black cement GST rate and HSN code are 28% and 2523, respectively.

4. Does Ultratech Cement have a different GST rate?

No, Ultratech Cement GST rate is 28%, same as other brands.

5. Can I claim GST refund on cement?

Only registered businesses can claim Input Tax Credit (ITC).

6. Why is cement GST so high in India?

The government classifies it as a “luxury” item, unlike essential goods.

7. Is GST on cement the same in all states?

Yes, GST is uniform, but check local cess or transportation fees.

8. What’s the GST rate for Portland cement?

Portland cement GST rate is 28% (HSN 2523).

9. Will GST on cement reduce in 2026?

Unlikely unless the government revises classification.

10. How is Ambuja Cement taxed?

Ambuja Cement GST rate is 28%, like most brands.

Conclusion

Understanding cement GST rate is crucial for builders, homeowners, and even DIY enthusiasts. While 2025 hasn’t brought rate cuts, smart planning (like using white cement or bulk buying) can ease the tax burden. Stay updated, save money, and build wisely!

In 2025, the cement GST rate continues to be a critical factor influencing construction budgets across India. With most cement types taxed at 28%, and white cement slightly lower at 18%, understanding these rates isn’t just useful—it’s essential. Whether you’re a homeowner planning your dream house, a builder managing large-scale projects, or simply someone keeping an eye on expenses, being GST-savvy can save you thousands. By leveraging input tax credits, choosing the right cement type for the right task, and negotiating bulk deals, you can minimize your tax burden without compromising quality. Stay informed, make smart buying decisions, and keep building toward a stronger future—brick by brick, tax by tax.