Confused about the bricks GST rate in 2025? Here’s a detailed guide that includes cement bricks GST rate, red bricks GST rate, fly ash bricks GST rate and HSN code, and much more. Also includes an Easy GST Calculator and FAQs.

When we talk about building a home, office, or any kind of structure in India, bricks play a very important role. But many people, especially small builders and common citizens, get confused when it comes to tax. In 2025, understanding the bricks GST rate has become very important. Whether you are using red bricks, fly ash bricks, soil bricks, or cement bricks, each type has a different GST rate and HSN code. This article will help you understand all about it in very simple language.

What is GST and Why Does It Matter for Bricks?

GST means Goods and Services Tax. It is a single tax system that was introduced in India in 2017. It replaced many old taxes like VAT, service tax, etc. Every item or service now comes under GST, including building materials like bricks.

When you buy bricks in 2025, you must check the bricks GST rate because it affects the total cost. Knowing the GST rate helps builders, dealers, and even customers to plan their budget properly.

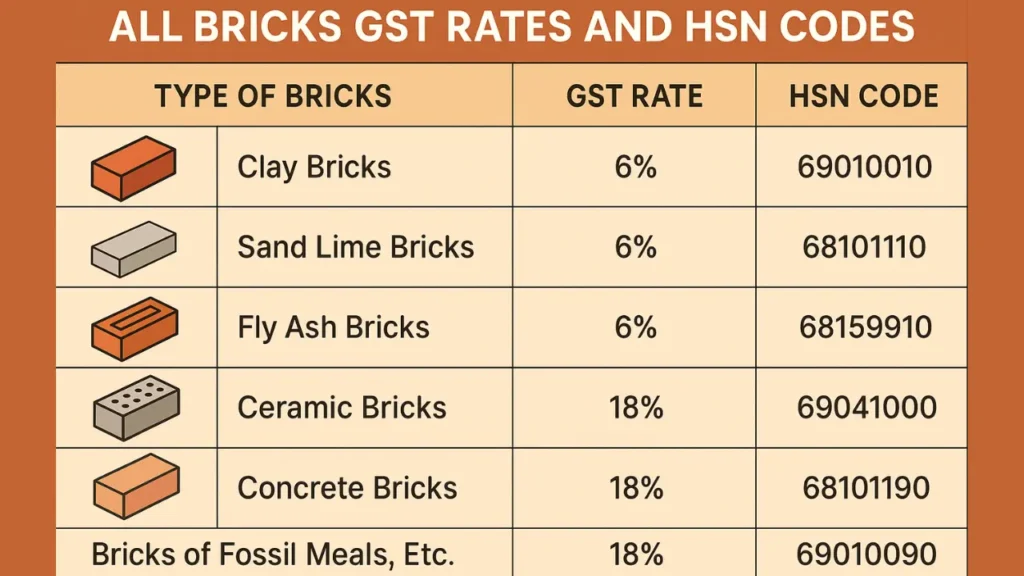

Bricks GST Rate and HSN Code

Every item under GST has an HSN code. HSN means Harmonized System of Nomenclature. It is a unique code used to classify goods. Bricks also have different HSN codes depending on the type.

| Type of Bricks | GST Rate 2025 | HSN Code |

|---|---|---|

| Red Bricks | 5% | 69010010 |

| Clay Bricks | 5% | 69010010 |

| Fly Ash Bricks | 12% | 68159910 |

| Soil Bricks | 5% | 69010010 |

| Cement Bricks | 18% | 68109100 |

| Hollow Bricks | 12% | 68159910 |

| Interlocking Bricks | 18% | 68159910 |

| Mud Bricks | 5% | 69010010 |

Note: GST rates and HSN codes are updated from time to time. The above data is accurate as of 2025.

Easy GST Calculator for Bricks

To make your life easier, here’s how you can calculate GST on bricks:

Formula: Total Price = Price Without GST + (Price Without GST × GST Rate %)

Example: If fly ash bricks cost ₹5000 (without GST), and the GST rate is 12%, then: GST Amount = ₹5000 × 12% = ₹600 Total Price = ₹5000 + ₹600 = ₹5600

You can also use an Easy GST Calculator online to do this quickly.

Try Our Free Online GST Tools

Red Bricks GST Rate and HSN Code in 2025

Red bricks are the most commonly used bricks in India. They are made from natural clay and fired in kilns. They are strong and long-lasting.

Red bricks GST rate in 2025 is 5%. HSN Code for red bricks is 69010010.

Whether you are building a house or a small shop, red bricks are the go-to choice in villages and small towns.

Fly Ash Bricks GST Rate and HSN Code 2025

Fly ash bricks are made using industrial waste and are considered eco-friendly. They are lighter and more uniform than clay bricks.

Fly ash bricks GST rate in 2025 is 12%. HSN Code is 68159910.

These are widely used in cities and smart housing projects due to their strength and finish.

Cement Bricks GST Rate and HSN Code

Cement bricks are made with cement, sand, and aggregates. They are mostly used for load-bearing walls.

Cement bricks GST rate in 2025 is 18%, which is higher than others. HSN Code: 68109100.

Because of their higher tax rate, cement bricks are usually used only when strong load-bearing is needed.

Cement GST Rate 2025: Shocking Updates Every Builder & Homeowner Must Know!

Soil Bricks GST Rate in 2025

Soil bricks are similar to clay bricks but can include additional materials like sand or lime.

GST Rate: 5% HSN Code: 69010010

These are still used in some rural constructions.

Clay Bricks GST Rate in 2025

Clay bricks are traditional and made from natural clay. They are strong but slightly less durable than fly ash or cement bricks.

GST Rate: 5% HSN Code: 69010010

Used in both urban and rural construction.

Hollow Bricks GST Rate 2025

Hollow bricks are lightweight and used in modern buildings for partition walls.

GST Rate: 12% HSN Code: 68159910

They help in reducing the load on the structure.

Interlocking Bricks GST Rate 2025

Interlocking bricks fit into each other without mortar. Very useful in quick construction projects.

GST Rate: 18% HSN Code: 68159910

These are popular in eco homes and boundary wall construction.

Building Bricks GST Rate

This is a general category that includes all types of bricks used for building.

GST Rate varies from 5% to 18%, depending on type.

Mud Bricks GST Rate

Mud bricks are made with natural mud and straw. These are used in traditional village homes.

GST Rate: 5% HSN Code: 69010010

These are not very common in cities now.

Cement Hollow Bricks GST Rate

These are hollow bricks made with cement. Lightweight but strong.

GST Rate: 18% HSN Code: 68159910

Used in modern high-rise buildings.

All Bricks GST Rates and HSN Codes (2025)

| Brick Type | GST Rate | HSN Code |

|---|---|---|

| Red Bricks | 5% | 69010010 |

| Clay Bricks | 5% | 69010010 |

| Fly Ash Bricks | 12% | 68159910 |

| Soil Bricks | 5% | 69010010 |

| Cement Bricks | 18% | 68109100 |

| Hollow Bricks | 12% | 68159910 |

| Interlocking Bricks | 18% | 68159910 |

| Mud Bricks | 5% | 69010010 |

| Cement Hollow Bricks | 18% | 68159910 |

FAQ : Common Questions About Bricks GST Rate

What is the GST rate for red bricks in 2025?

Red bricks have a 5% GST rate.

What is the HSN code for fly ash bricks?

HSN code for fly ash bricks is 68159910.

How much GST do I need to pay on cement bricks?

18% GST is need to pay on cement bricks in 2025.

Are all bricks taxed the same under GST?

No, GST varies depending on type of brick.

What is the Easy GST Calculator?

It helps you quickly find the total price of bricks including GST.

Which bricks are eco-friendly and have lower GST?

Clay bricks and soil bricks have 5% GST and are eco-friendly.

Why is GST on cement bricks so high?

Because they are considered as processed construction material.

Can GST rates change again?

Yes, GST Council can revise the rates anytime.

Is 12% GST for fly ash bricks fixed?

As of 2025, yes. But keep checking for updates.

Where can I check official GST updates?

You can visit https://www.cbic.gov.in for latest updates.

Also Read

Conclusion: Know Your Brick to Save More in 2025

Whether you are a builder, a dealer, or a simple homeowner planning to build your dream house, knowing the correct bricks GST rate can help you save money. From red bricks to fly ash and cement bricks, every type has a different rate and HSN code. Use this guide to make smart decisions and plan your budget better in 2025.

Stay updated and always use a trusted Easy GST Calculator for your next purchase!