Confused about the furniture GST rate in India for 2025? Here’s a complete and simple guide covering wood, steel, plastic, modular, office, and school furniture GST rates with HSN codes, calculator tips, and FAQs.

Furniture is something that every home, office, and school needs. But do you know how much GST you pay when you buy or sell furniture? GST (Goods and Services Tax) has changed how furniture is priced in India. From a wooden chair in your living room to modular office furniture, each item has a different furniture GST rate.

As we move into 2025, understanding the latest updates on furniture GST rates is important for both buyers and sellers. This article is a full guide in simple Indian English about all types of furniture GST rates like wooden furniture GST rate and HSN code, steel furniture GST rate, office furniture GST rate, and many more. We will also talk about how to use an Easy GST Calculator to check the tax.

What is GST and Why It Matters for Furniture?

GST (Goods and Services Tax) is a single tax that replaced many old taxes in India. It is collected at every step in the supply chain and finally paid by the customer. GST on furniture affects the price you pay whether you buy a small wooden stool or a full office furniture set.

The furniture GST rate depends on material type like wood, steel, plastic, or cane. It also depends on whether the furniture is for home, office, school, or modular use.

In 2025, the furniture GST rate has been kept mostly stable, but some updates have come in HSN codes and some rates.

Wooden Furniture GST Rate and HSN Code

Wooden furniture is very common in Indian homes. Things like beds, tables, chairs, and wardrobes come under this category. In 2025, the wooden furniture GST rate remains at 18%. This is the standard rate for most wooden furniture whether it is teak, mango wood, or plywood.

- HSN Code: 9403 is used for most wooden furniture.

- Rate: 18%

Example: If you buy a wooden dining table worth Rs. 10,000, then GST of Rs. 1,800 will be added.

Wood Furniture GST Rate: Solid vs Plywood

When we talk about wood furniture, it also includes both solid wood and plywood furniture. While both are covered under the same GST rate of 18%, many people confuse them as separate.

- Plywood furniture GST rate: 18%

- Solid wood furniture GST rate: 18%

So, whether your sofa is made from plywood or sheesham wood, the GST rate remains the same.

Steel Furniture GST Rate in 2025

Steel furniture is popular in schools, offices, and modern homes. Items like metal wardrobes, study desks, and office chairs often use steel. In 2025, the steel furniture GST rate is 18%.

- HSN Code: 9403

- Rate: 18%

Example: Office metal file cabinet worth Rs. 5,000 will have Rs. 900 GST.

Office Furniture GST Rate

Whether it’s a desk, chair, or full workstation, office furniture is taxed at the standard 18% GST. Businesses can claim ITC (Input Tax Credit) if used for business purposes.

Tip: If you are a business owner, you can save money by claiming GST as Input Tax Credit.

Plastic and Metal Furniture GST Rate

Plastic furniture is used in homes, events, and even schools. Metal furniture includes iron and aluminum-based furniture. Both fall under 18% GST.

- Plastic furniture GST rate: 18%

- Metal furniture GST rate: 18%

- Iron furniture GST rate: 18%

Modular Furniture GST Rate

Modular furniture is growing fast in cities. Modular kitchens, modular wardrobes, etc., are all taxed at 18% GST under HSN Code 9403.

Note: Modular furniture is considered a service if installed onsite. Then, it may attract 18% GST with service classification.

Cane and School Furniture GST Rate

Cane furniture, which is eco-friendly and used in balconies and cafes, is also taxed at 18% GST. School furniture, used in classrooms like desks, benches, and chairs, also follows the 18% GST rate.

Furniture GST Rate and HSN Code in 2025

| Type of Furniture | GST Rate | HSN Code | Material Type |

|---|---|---|---|

| Wooden Furniture | 18% | 9403 | Sheesham, Teak, etc. |

| Plywood Furniture | 18% | 9403 | Plywood, Veneer |

| Steel Furniture | 18% | 9403 | Stainless Steel |

| Office Furniture | 18% | 9403 | Mixed (Wood, Metal) |

| Plastic Furniture | 18% | 9403 | Polypropylene, etc. |

| Metal/Iron Furniture | 18% | 9403 | Iron, Aluminium |

| Modular Furniture | 18% | 9403 | Modular, Fitted |

| Cane Furniture | 18% | 9403 | Cane, Bamboo |

| School Furniture | 18% | 9403 | Wood, Plastic, Metal |

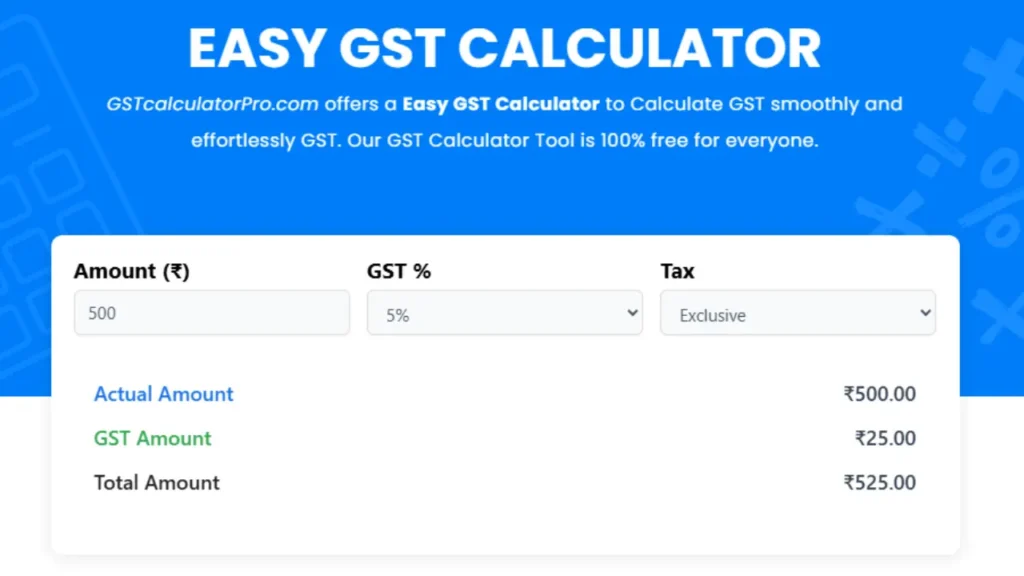

How to Use an Easy GST Calculator for Furniture

Using an Easy GST Calculator can help you know the final cost of furniture. These are available online, and you just need to enter:

- Price before GST

- GST rate (usually 18%)

The calculator will show the tax amount and total price.

Example: For a chair worth Rs. 2,000

- GST: Rs. 360

- Total: Rs. 2,360

Furniture GST Rate New Updates for 2025

In 2025, the government has kept most furniture GST rates stable at 18%. But updates in HSN codes for classification have been made for clarity. Some states have also pushed for reducing GST on eco-friendly furniture like cane and bamboo, but no official reduction has come yet.

FAQ: Furniture GST Rate in India (2025)

What is the GST rate on furniture in 2025?

It is 18% for almost all types of furniture.

What is the HSN code for wooden furniture?

9403 is the common HSN code.

Is there a different GST for plastic furniture?

No, plastic furniture also has 18% GST.

Can I claim GST on office furniture?

Yes, if you are a registered business.

How do I calculate GST on furniture?

Use an Easy GST Calculator online.

Is modular kitchen furniture taxable under GST?

Yes, 18% as goods or services depending on delivery.

What is the GST rate on school furniture?

18% under HSN 9403.

Do iron and metal furniture have different GST?

No, they are all taxed at 18%.

Are there any GST exemptions on furniture?

No exemptions for now.

Does cane furniture have lower GST?

Not currently, still 18%.

Conclusion on Furniture GST Rate in 2025

Understanding the furniture GST rate in India for 2025 helps you make better decisions whether you are buying a bed for home or setting up an office. Most furniture, regardless of material—wood, steel, plastic, or cane—falls under the 18% GST rate. By knowing the HSN code and using an Easy GST Calculator, you can easily find out how much GST you are paying.

Keep checking for updates from GST Council as they may bring changes in rates or codes in the future. Until then, use this guide to stay informed and shop smart!