Learn everything about GST on mobile phones in India for 2025—rates, HSN codes, billing, claims, calculators, and FAQs. Stay updated with the new GST rate structure and how to claim GST on your smartphone purchases.

GST on Mobile Phones

Goods and Services Tax (GST) is a unified indirect tax regime implemented across India to streamline taxation and reduce cascading taxes. As smartphones have become an indispensable part of our lives, understanding gst on mobile phone purchases and services is crucial for consumers and businesses alike. From knowing the right mobile phone gst rate in india to determining whether gst on mobile phone bill can be claimed, this article covers every angle.

In 2025, the Indian government has updated several GST slabs impacting mobile phones. Whether you are curious about mobile phone gst rate 2025 or need guidance on how to calculate gst on mobile phone, read on to get clear, step-by-step insights.

What Is the GST Rate on Mobile Phones in India in 2025?

The mobile phone gst rate in india is determined by factors such as price, capacity, and HSN code classification. For 2025, the following rates generally apply:

- 12% GST: Applicable on mobile phones priced up to INR 50,000.

- 18% GST: Applicable on selected models and brands.

- 28% GST: Applicable on premium models priced above INR 50,000, including many flagship devices.

These changes came after the Union Budget 2025 announcement, which aimed to simplify tax slabs and align them with global standards. Whether you are asking, “Is GST on mobile phones 12%?” or “GST on mobile phones above 50000?” this section clarifies the new slabs and implications for buyers and sellers.

HSN Codes for Mobile Phones and Accessories

Every taxable supply in India is classified under the Harmonized System of Nomenclature (HSN). Mobile phone gst rate and hsn code are essential for businesses to file accurate GST returns. The typical HSN codes are:

| Description | HSN Code | GST Rate |

|---|---|---|

| Mobile phones | 8517 | 12%, 18%, or 28% |

| Mobile phone accessories | 8518 | 18% |

Knowing the Mobile accessories HSN code helps you determine gst on mobile phone accessories like chargers, headsets, and cases. Accurate classification prevents errors during e-way bill generation and GST return filings.

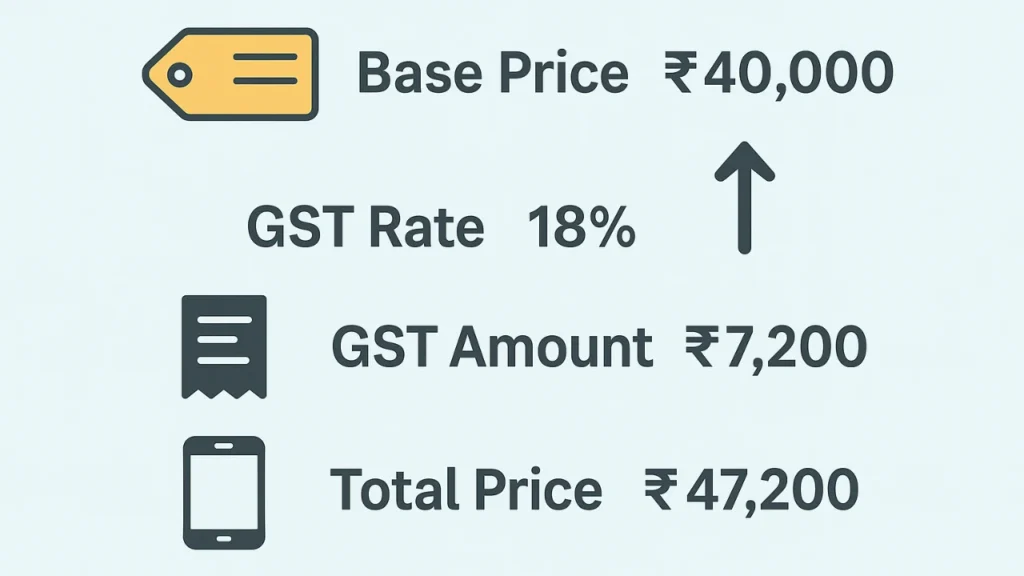

How to Calculate GST on Mobile Phones

Calculating GST on mobile phones is straightforward with the right method. Follow these steps:

- Identify the base price of the phone (excluding any additional charges).

- Determine the applicable GST rate (e.g., 18% for a mid-range phone).

- Apply the GST formula: GST Amount = (Base Price × GST Rate) / 100.

- Compute the total price: Total Price = Base Price + GST Amount.

For example, if a phone costs INR 40,000 and the GST rate is 18%, then:

GST Amount = (40,000 × 18) / 100 = INR 7,200. Total Price = 40,000 + 7,200 = INR 47,200.

To simplify calculations, use an Easy GST Calculator or Mobile phone gst rate calculator available online. These tools let you input the base price and instantly compute GST, saving time and preventing manual errors.

Try Our Free Online GST Tools

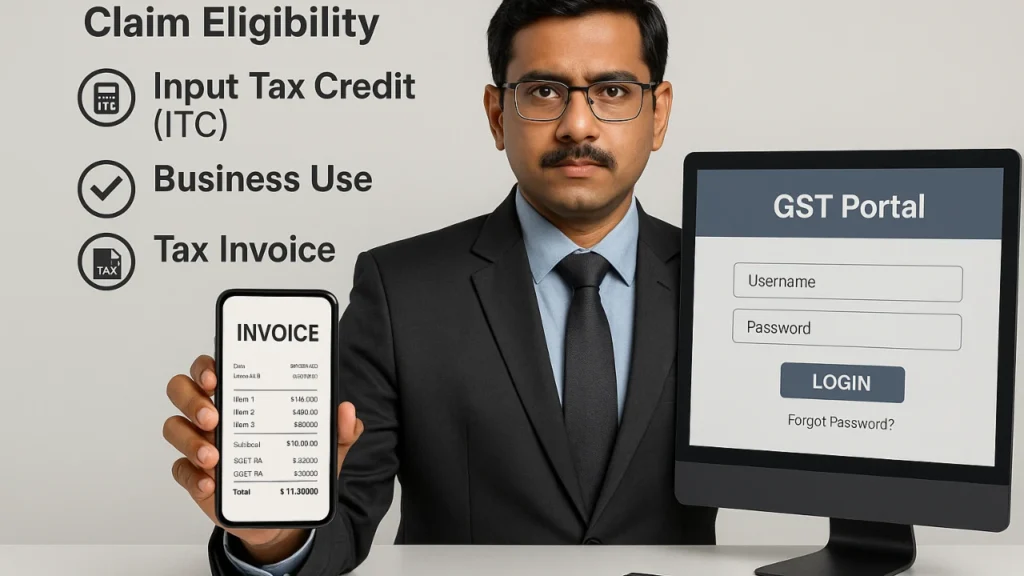

Claiming GST on Mobile Phone Purchases: Who and How?

Can we claim GST on mobile phone purchase? The answer depends on whether the phone is bought for business or personal use:

- Business Use: Registered businesses can claim Input Tax Credit (ITC) on mobile phone purchases if the phone is used exclusively for business. You must have a valid tax invoice and ensure the phone is used for business-related activities.

- Personal Use: Individuals cannot claim GST on personal mobile phone purchases.

For How to claim GST on mobile purchase, file your GSTR-2 return with the supplier’s invoice details. Keep an eye on the gst on mobile phone bill, which must clearly show the GST amount segregated under CGST, SGST, or IGST.

GST on Specific Models: iPhone, Samsung, and More

Every brand and model may attract different GST treatments:

- What is the GST rate of iPhone 14? Generally 28% if the price crosses the premium threshold.

- How much GST on iPhone 15 128GB? At 28%, on a base price of INR 79,900, GST would be around INR 22,372.

- What is the GST rate of Samsung phone? Depends on model—mid-range models often attract 18%, while flagship models cross the 28% slab.

This section helps consumers answer questions such as Mobile GST rate 28 percent List and GST on mobile phones above 100000.

GST on Mobile Phone Recharge and Postpaid Bills

GST applies not only to the purchase of devices but also to related services:

- gst on mobile phone recharge: A flat 18% GST is levied on prepaid recharge vouchers.

- Postpaid Bills: Telecom operators levy 18% GST on monthly service bills.

Whether you top up your prepaid balance or pay a postpaid bill, understanding gst on mobile phone bill helps you budget better and reconcile your expenses in financial records.

Recent Updates and Budget 2025 Impacts

The mobile phone gst rate budget 2025 brought minor tweaks to align taxation with market realities:

- Consolidation of sub-rates under 12%, 18%, and 28% for clarity.

- No change in the Mobile GST rate 28 percent List, keeping premium segment taxation intact.

- Simplified HSN code usage and faster e-invoicing for high-value mobile transactions.

These updates aim to boost smartphone penetration while ensuring adequate government revenue from luxury gadgets.

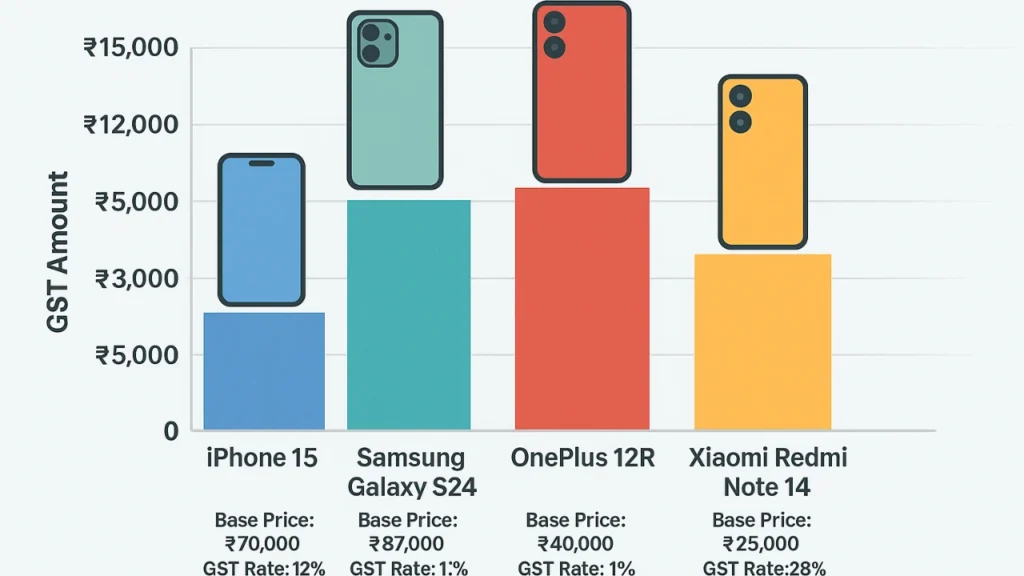

Comparative GST Rates on Popular Smartphones

Below is a table showcasing GST rates on some popular smartphone models in India, reflecting 2025 rates and HSN codes. Use this to compare tax liabilities before you buy.

| Model | Base Price (INR) | GST Rate | GST Amount (INR) | Total Price (INR) | HSN Code |

|---|---|---|---|---|---|

| iPhone 15 (128GB) | 79,900 | 28% | 22,372 | 102,272 | 8517 |

| Samsung Galaxy S24 | 69,900 | 28% | 19,572 | 89,472 | 8517 |

| OnePlus 12R | 44,999 | 18% | 8,100 | 53,099 | 8517 |

| Xiaomi Redmi Note 14 | 15,999 | 12% | 1,920 | 17,919 | 8517 |

Also Read

FAQs.

- Is GST on mobile phones 12%? Only for phones priced up to INR 50,000; premium models attract higher rates.

- Can we claim GST on mobile phone purchase? Yes, if bought for business use and claimed under ITC with a valid invoice.

- What is the GST rate of Samsung phone? Depends on model—mid-range often 18%, flagship 28%.

- How much GST on iPhone 15 128GB? At 28%, approximately INR 22,372 on a base price of INR 79,900.

- Mobile phone gst rate calculator: Is there an easy tool? Yes, many online Easy GST Calculators can compute GST instantly.

- What is the HSN code for mobile accessories? 8518, taxed at 18%.

- How to calculate gst on mobile phone bill? Sum base price and apply rate: (Price × Rate)/100.

- GST on mobile phones above 100000: What’s the rate? Premium GST slab of 28% applies.

- GST on mobile phone recharge: What rate? 18% on all prepaid recharges and postpaid bills.

- Mobile GST rate 28 percent List: Which phones fall here? Flagship models from Apple, Samsung, OnePlus, etc.

Conclusion

Understanding gst on mobile phone in India helps consumers and businesses make informed decisions. From base rates to claiming procedures, we’ve covered everything you need for 2025. Use the Easy GST Calculator for quick computations, verify mobile phone gst rate and hsn code, and keep this guide handy when purchasing or recharging your device. Stay tax-savvy and enjoy your smartphone without surprises!