A friendly guide to gst on upi transactions in india: rates, charges, calculator, and expert tips for 2025

Introduction

In recent years, India’s digital payments have grown by leaps and bounds. One of the most popular modes of cashless payment is the Unified Payments Interface (UPI). But as transactions soar, many ask: “What about GST on UPI transactions?” In this comprehensive guide, we’ll explore gst on upi transactions, from gst on upi transactions in india to gst rate on upi transaction, including cases where gst on upi transactions below 2000 applies. We’ll also introduce an Easy GST Calculator and show you how to use it. By the end, you’ll have crystal‑clear insights, recent updates for 2025, helpful examples, and a handy table of GST charges on UPI transaction amounts. Let’s dive in, shall we?

What Is GST on UPI Transactions in India?

GST on UPI transactions in India is 18% tax charged on service fees like MDR or convenience fees by banks or apps. It does not apply to the actual transaction amount but only to the service component involved in processing the UPI payment.

Goods and Services Tax (GST) is India’s unified indirect tax replacing multiple taxes like service tax and VAT. While UPI itself is a payment interface, the underlying services—such as payment gateway services, merchant discount rates (MDR), and convenience fees—can attract GST. Thus, when you send or receive money via UPI for goods or services, the service component may be subject to gst on upi transactions in india.

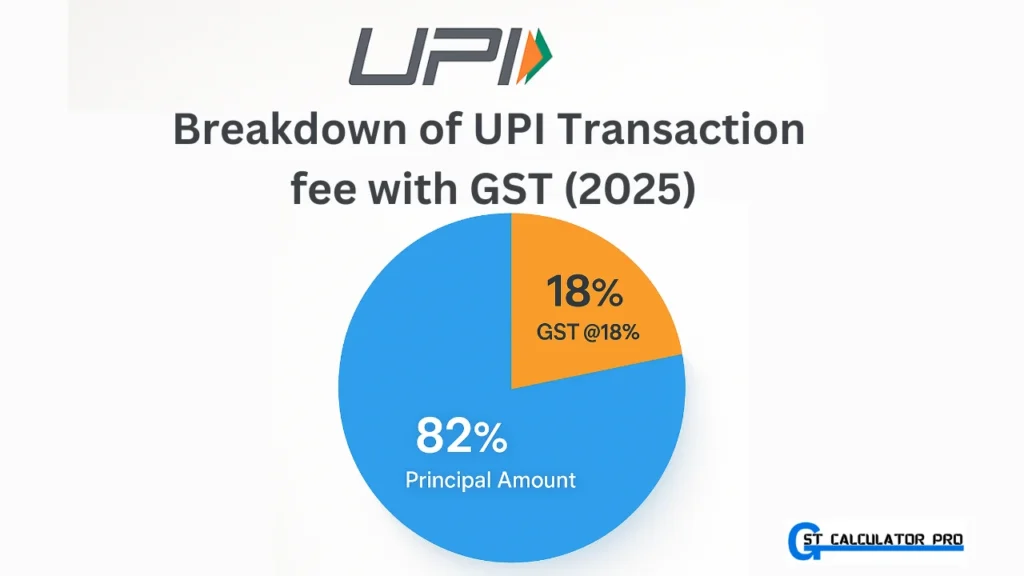

Every UPI transaction involves two parts:

- Principal Amount: The money you pay for goods or services.

- Service Charge Component: This includes MDR or convenience fees levied by your bank or third-party app.

The GST is levied only on the service charge, not on the principal amount. In 2025, the standard gst rate on upi transaction service fees remains 18%, unless specifically exempted by the GST Council. That means for every ₹100 of payment gateway fee, you pay ₹18 as GST. This clear split ensures transparency in your gst on upi transactions, allowing you to know exactly what you’re paying for the service and tax.

Understanding the 18% GST on UPI Transactions

One of the most hotly discussed topics is the 18 gst on upi transactions rate. In simple terms, banks and payment apps charge a small fee (MDR or convenience fee) for each UPI transfer. The GST Council has set the GST rate on such service fees at 18%.

- Example: If the MDR is ₹10, GST at 18% = ₹1.80.

- Total fee paid: ₹11.80.

This gst charges on upi transaction approach ensures that users see a transparent breakdown when they check transaction details. With digital wallets and UPI apps making life easy, the gst on upi transactions component is almost always tucked neatly into your payment receipt.

Key Points:

- Applicable only on the service fee, not on the amount you send or receive.

- Flat 18% GST on that service fee.

- Shown separately in transaction statements.

This simple structure makes it easy for you to calculate or verify gst on upi transactions below 2000, above ₹2000, or any amount. Remember, whether you send ₹50 or ₹5,000, the 18% applies only to the service fee.

GST on UPI Transactions Below ₹2,000: What Changes?

Many users wonder: does gst on upi transactions below 2000 differ? The answer is no. The GST Council has not provided a threshold exemption for UPI service fees. Whether your UPI payment is ₹100 or ₹1,999, the GST at 18% applies equally to the service fee portion.

- ₹100 transaction with ₹2 MDR: GST = ₹0.36; Total service charge = ₹2.36.

- ₹1,500 transaction with ₹5 MDR: GST = ₹0.90; Total service charge = ₹5.90.

This uniform gst on upi transactions approach keeps compliance simple for banks, payment apps, and merchants. For micro-merchants or street vendors receiving small payments, the extra few paise of GST on the service fee is marginal, but it ensures they remain within the formal economy, benefiting long-term from input tax credits and formal invoicing.

Easy GST Calculator: Simplify Your Calculations

Calculating gst on upi transactions manually for each payment can be tedious. That’s why we’ve built an Easy GST Calculator—a quick, user‑friendly tool to compute reverse GST on service fees instantly.

Use our calculator here: Reverse GST Calculator

Features:

- Enter total service fee, get the pre‑GST fee and GST component.

- Adjust the GST rate if the government updates it in future.

- Works for any transaction amount.

With this gst calculator, you never need to scratch your head over decimals. For merchants, small businesses, or individuals, it’s a one‑stop solution to handle gst charges on upi transaction fees accurately.

How to Use the Easy GST Calculator for UPI Transactions

Let’s walk through a step-by-step on using our Easy GST Calculator for gst on upi transactions in india:

- Visit the Reverse GST Calculator page.

- Enter the total service fee you were charged—for example, ₹11.80.

- Select the GST rate (default is 18%).

- Click “Calculate.”

You’ll instantly see:

- Service Fee before GST: ₹10.00

- GST Component (18%): ₹1.80

This tool is invaluable when reconciling your monthly statements or preparing invoices. It takes the guesswork out of gst rate on upi transaction and ensures your books are always accurate.

Try Our Free Online GST Tools

Impact on Small Businesses and Consumers

For small businesses and everyday consumers, understanding gst on upi transactions is crucial:

- Merchants gain clarity on the exact service charge and tax component, aiding in precise bookkeeping.

- Customers see transparency in receipts, building trust in digital payments.

- Economy benefits as more transactions enter the formal system, widening the tax base.

Even for gst on upi transactions below 2000, that tiny paise‑level GST component helps the government collect revenues that fund public goods. Over millions of UPI transfers daily, the cumulative GST contributes significantly to state and central exchequers.

Common Mistakes to Avoid and Pro Tips

When dealing with gst on upi transactions, beginners often slip up. Here are top pitfalls and how to avoid them:

- Mistaking Principal for Fee: Remember, GST applies only to the service fee, not your purchase amount.

- Ignoring Small Fees: Even tiny INR‑level fees carry an 18% GST—track every paise.

- Manual Calculation Errors: Decimals can trip you; use the Easy GST Calculator.

- Forgetting Documentation: Always save UPI receipts showing service charges and GST.

- Assuming Exemptions: There’s no exemption for transactions below ₹2,000.

Pro Tips:

- Set monthly reminders to reconcile UPI statements.

- Use spreadsheet templates pre‑loaded with GST formulas.

- Regularly check for GST Council updates; rates can change.

Recent Updates for 2025 on GST and UPI Payments

In April 2025, the GST Council reviewed digital payment levies. Key takeaways:

- No change to the 18% rate on service fees for UPI transactions.

- Enhanced compliance for large payment apps to display GST breakup prominently.

- Discussion underway for a possible reduced rate for micro‑MDR (<₹1 per transaction), pending final approval.

Stay tuned to official GST Council releases to know when any change to gst rate on upi transaction or gst charges on upi transaction below ₹1 comes into effect. Until then, continue with the standard 18%.

Sample GST Charges on UPI Transactions

| Transaction Amount (₹) | MDR/Service Fee (₹) | GST @18% (₹) | Total Fee Paid (₹) |

|---|---|---|---|

| 100 | 2.00 | 0.36 | 2.36 |

| 500 | 3.50 | 0.63 | 4.13 |

| 1,000 | 5.00 | 0.90 | 5.90 |

| 1,500 | 5.00 | 0.90 | 5.90 |

| 2,000 | 6.00 | 1.08 | 7.08 |

| 5,000 | 8.00 | 1.44 | 9.44 |

This table clarifies how gst on upi transactions scales with different service fees, irrespective of the transaction amount.

Conclusion

Digital payments are here to stay, and understanding gst on upi transactions is vital for both individuals and businesses. Whether you’re dealing with gst on upi transactions below 2000 or reconciling bulk merchant collections, remember that the 18% GST applies only on service charges. Use our Easy GST Calculator for error‑free calculations, keep an eye on recent 2025 updates, and follow our tips to avoid common mistakes. With this guide, you’re now fully equipped to handle GST on UPI transactions confidently and seamlessly.

Also Read

FAQ About GST on UPI Transactions in India

What exactly is GST on UPI transactions?

GST on UPI transactions refers to the 18% tax levied on service fees (like MDR) charged by banks or payment apps, not on the principal payment amount.

Is gst on upi transactions in india applicable to all banks?

Yes. All UPI‑enabled banks and third‑party apps must charge 18% GST on their service fees.

Do I pay GST on UPI transactions below ₹2,000?

Yes. There is no exemption threshold; any service fee attracts 18% GST, regardless of transaction size.

Can I claim input tax credit on gst charges on upi transaction?

Businesses registered under GST can claim ITC on the GST component of UPI service fees if used for business purposes.

How do I calculate the gst rate on upi transaction?

Multiply the service fee by 0.18. For example, ₹10 fee → ₹10 × 18% = ₹1.80 GST.

Is there any change in gst on upi transactions for 2025?

As of April 2025, the rate remains 18%, though small fee exemptions are under discussion.

What is the easiest way to calculate gst on upi transactions?

Use our Easy GST Calculator for instant breakdown.

Are convenience fees on UPI also subject to GST?

Yes. Any fee—MDR, convenience fee, or gateway fee—is subject to 18% GST.

Do peer‑to‑peer UPI transfers attract GST?

No. Person‑to‑person transfers without any service fee do not attract GST.

How often should I reconcile GST on UPI transaction charges?

Monthly reconciliation is recommended to match your bank statements, invoices, and GST returns.