Confused about the latest hotel GST rate in India? This 2025 guide explains GST on hotels, restaurants, and room rent in simple terms. Know the updated hotel GST rate slab, food GST rate, and more.

If you plan to visit or opening a hotel or restaurant in India, knowing the hotel GST rate is very important. In 2025, some new rules and rates have been introduced by the Indian Government. This article will help you understand the GST rate on hotel, restaurant GST rate, and how much tax you pay when staying in a hotel room or eating in a restaurant.

What is the GST Rate on Hotel or Restaurant?

As per the latest update for 2025, the GST rate on hotels in India depends on the room rent per night. Here’s the direct breakdown:

- Room rent below ₹1,000 – 0% GST (No tax)

- ₹1,001 to ₹2,500 per night – 12% GST

- ₹2,501 to ₹7,500 per night – 18% GST

- Above ₹7,500 per night – 28% GST (Luxury GST slab)

These rates are the same whether you stay in a regular AC hotel, 3-star, 4-star, or a luxury 5-star hotel like Taj. Even residential hotels follow this slab. The new GST rate on hotel room rent introduced in 2025 is helpful for budget travelers, especially as bookings under ₹1,000 are now fully tax-free.

For example, if your room costs ₹3,000 per night, the GST rate will be 18%, and your final bill becomes ₹3,540.

Always check the current hotel GST rate before booking, as it affects your final price. This GST is usually included in the total when booking online through travel apps or websites.

What is GST and Why It Applies to Hotels?

GST means Goods and Services Tax. This is a tax added on goods and services in India. Hotels, restaurants, and room services are also part of this.

If you book a hotel room or eat in a hotel restaurant, you have to pay GST. The rate depends on:

- Price of hotel room

- Type of hotel (non-AC, AC, 3-star, 4-star, 5-star, luxury)

- Services provided

NEW HOTEL GST RATE SLAB 2025

Here is the updated hotel GST rate slab for 2025:

| Room Rent (Per Night) | Hotel GST Rate 2025 |

|---|---|

| Below ₹1,000 | 0% (No GST) |

| ₹1,001 to ₹2,500 | 12% |

| ₹2,501 to ₹7,500 | 18% |

| Above ₹7,500 | 28% (Luxury Rate) |

This slab is applicable to all types including residential hotel GST rate, AC hotel GST rate, and Taj hotel GST rate.

GST RATE ON HOTEL ROOM RENT BELOW ₹1,000

If your room rent is below ₹1,000 per night, you do not have to pay any GST. This is good for budget travellers. Many 2-star and small hotels fall in this category.

Example: If you book a room for ₹950 per night, you will pay only ₹950. No GST.

HOW TO CALCULATE GST ON HOTEL ROOMS

Very simple way to calculate:

Try Our Free Online GST Tools

Formula:

Room Rent x GST % = GST Amount

Then,

Room Rent + GST Amount = Final Bill

Example: Room rent is ₹3,000 per night. GST rate is 18%.

- GST = 3000 x 18% = ₹540

- Final Bill = 3000 + 540 = ₹3,540

RESTAURANT GST RATE 2025

When you eat in a hotel or standalone restaurant, you also pay GST. The restaurant GST rate is different depending on type of restaurant.

| Type of Restaurant | GST Rate |

| Non-AC Restaurant | 5% (No ITC) |

| AC Restaurant | 18% (With ITC) |

| Takeaway or Delivery | 5% |

| Outdoor Catering | 18% |

GST ON HOTEL ROOMS IN INDIA 2025

Whether it’s a 3 star hotel GST rate or a five star hotel GST rate, all follow the same slab. Some luxury hotels and resorts charge 28% GST if room rent is above ₹7,500.

Here are some examples:

- 3 Star Hotel GST Rate: Usually 12% to 18%

- 4 Star Hotel GST Rate: Mostly 18%

- 5 Star Hotel GST Rate: Mostly 28% (Luxury Slab)

- Luxury Hotel GST Rate: 28%

| Hotel Types | GST Rate |

| 3 Star Hotel GST Rate | 12% to 18% |

| 4 Star Hotel GST Rate | 18% |

| 5 Star Hotel GST Rate | 28% |

| Luxury Hotel GST Rate | 28% |

TAJ HOTEL GST RATE (2025)

Taj is a 5-star and luxury brand. Most Taj hotels charge above ₹7,500 room rent, so GST will be 28%. If you eat in their restaurant, 18% GST applies.

Example:

- Room Rent = ₹10,000

- GST = 28% = ₹2,800

- Total Bill = ₹12,800

Food Bill in Taj Restaurant:

- Food Price = ₹1,000

- GST = 18% = ₹180

- Total = ₹1,180

Also Read

- AC GST Rate 2025: Step-By-Step Complete Guide

- Cement GST Rate 2025: Shocking Updates Every Builder & Homeowner Must Know!

- Latest GST Rate Changes 2025: Impact on Businesses and Consumers

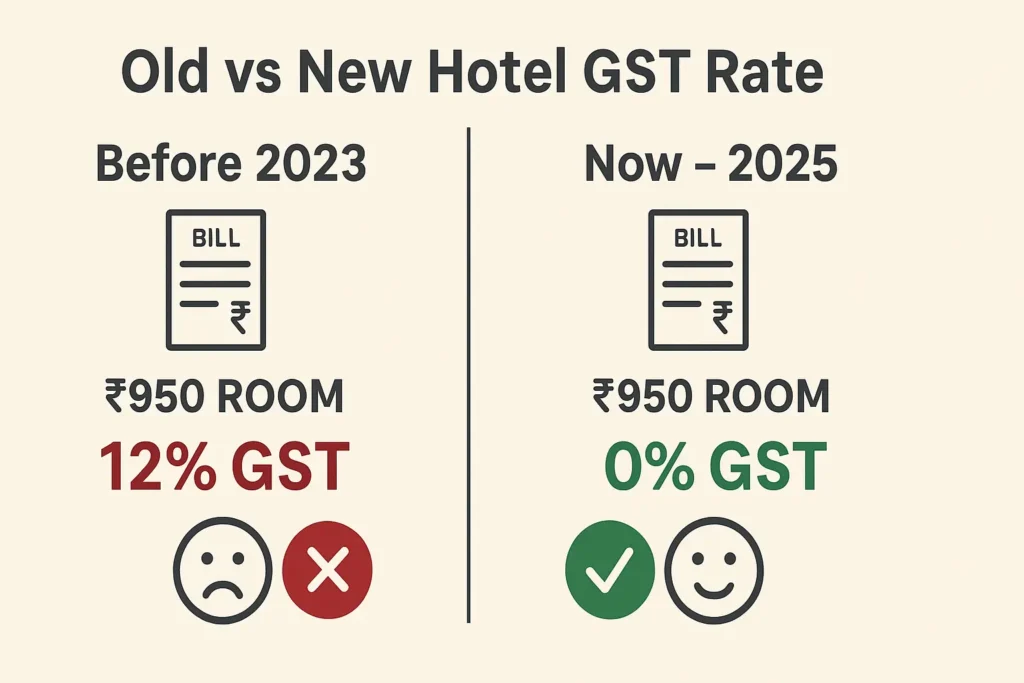

CURRENT HOTEL GST RATE VS OLD RATES-2025

Before, GST started from ₹1,000 room rent. Now, under ₹1,000 is 0%.

Old Rate (Before 2023):

- Even ₹950 room rent had 12% GST.

New Rate (2025):

- ₹950 room rent = No GST

This helps small and budget hotel customers.

FAQ

What is the hotel GST rate in 2025?

Hotel GST rate in 2025 ranges from 0% to 28% depending on room rent.

Is GST applicable on hotel room rent below ₹1,000?

No, GST is 0% if rent is below ₹1,000.

What is the restaurant GST rate in India?

For non-AC restaurants, it’s 5%. For AC restaurants, it’s 18%.

How to calculate GST on hotel rooms?

Use the formula: Room Rent x GST%. Then add both to get final amount.

What is the GST rate for 5-star hotels?

Usually 28% if room rent is above ₹7,500.

Is GST included in online hotel booking apps?

Yes, GST is included in the final price you see.

What is GST on food in hotels?

Food GST rate is 5% to 18% depending on AC or non-AC.

Do small hotels need to register under GST?

If total turnover is below limit (₹40 lakh), GST is not mandatory.

What is luxury hotel GST rate in India?

Luxury hotels with room rent above ₹7,500 have 28% GST.

Is GST on residential hotels different?

No, same GST slab applies as per room rent.

CONCLUSION: HOTEL GST RATE IN 2025

In 2025, understanding the hotel GST rate is important for both travellers and hotel owners. Whether it’s a 3-star or a Taj luxury hotel, the GST slab is now clearly divided. This helps you know what you’re paying for.

Hope this guide helped you learn about:

- GST rate on hotel room rent below 1,000

- How to calculate GST on hotel rooms

- Food GST rate on hotel

- Five star Restaurant GST rate and more.

Always check GST rates before booking your next hotel or dining at a fancy restaurant!