Learn how to calculate 18 percent GST in India with simple formulas, examples, and an easy GST calculator. Master removing GST from totals, understand MRP calculations, and get 2025 updates in this friendly guide!

How Do You Calculate 18% GST?

To calculate 18% GST: Multiply the original price by 0.18 for the GST amount. Add it to the original for the total.

Example: ₹1,000 × 0.18 = ₹180 GST. Total = ₹1,180.

Taxes can be confusing, but calculating GST doesn’t have to be! Whether you’re a student, business owner, or just curious, this guide will teach you how to calculate 18% GST like a pro. We’ll cover formulas, examples, and even how to use an easy GST calculator. Let’s dive in!

What is GST?

GST (Goods and Services Tax) is a single tax applied to most goods and services in India. It replaced older taxes like VAT and service tax, making the system simpler. The GST rate varies (5%, 12%, 18%, 28%), but 18% GST is common for items like smartphones, processed foods, and AC restaurants.

Why is 18% GST Important in India?

18% GST applies to everyday items and services. Knowing how to calculate 18% GST helps you:

- Understand product prices.

- File taxes correctly.

- Avoid overpaying.

GST Calculation Formula

The basic formula to calculate 18% GST is:

- GST Amount = Original Price × 18%

- Total Price = Original Price + GST Amount

For example:

- Original Price = ₹1,000

- GST = ₹1,000 × 0.18 = ₹180

- Total = ₹1,000 + ₹180 = ₹1,180

Examples of Calculating 18% GST

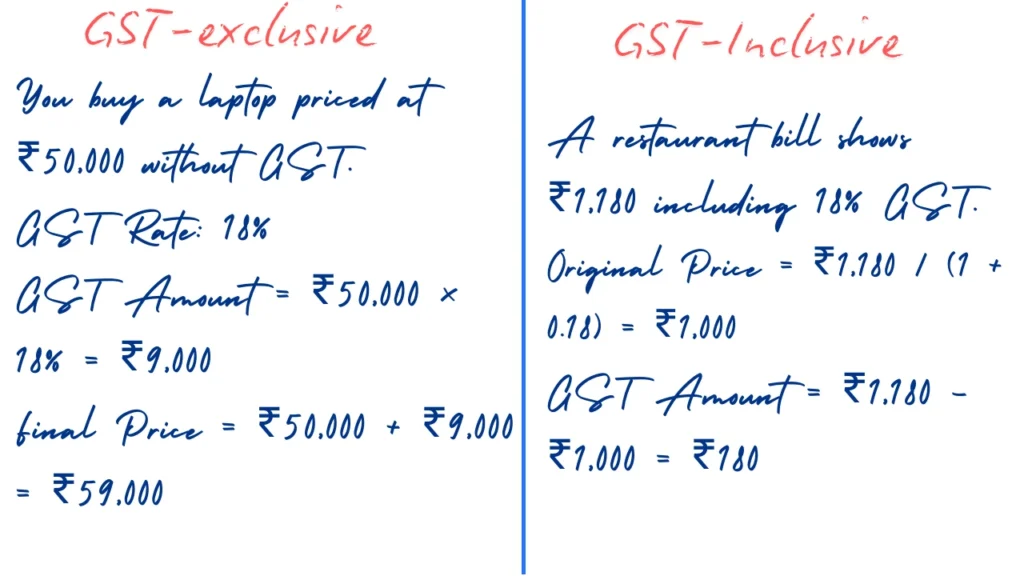

Example 1: Calculating GST on a Laptop

- Original Price = ₹50,000

- GST = ₹50,000 × 0.18 = ₹9,000

- Total Price = ₹50,000 + ₹9,000 = ₹59,000

Example 2: GST on Restaurant Bill

- Food Bill = ₹2,500

- GST = ₹2,500 × 0.18 = ₹450

- Total = ₹2,500 + ₹450 = ₹2,950

How to Remove GST from Total Amount (Reverse Calculation)

Try Our Free Online GST Tools

What if the price includes GST and you need to find the original amount? Use this formula:

- Original Price = Total Amount ÷ 1.18

- GST Amount = Total Amount – Original Price

Example:

Total Price = ₹1,180

- Original Price = ₹1,180 ÷ 1.18 = ₹1,000

- GST = ₹1,180 – ₹1,000 = ₹180

Calculating GST on MRP

MRP (Maximum Retail Price) already includes GST. To find the GST part:

- Original Price = MRP ÷ 1.18

- GST = MRP – Original Price

Example:

MRP = ₹590

- Original Price = ₹590 ÷ 1.18 = ₹500

- GST = ₹590 – ₹500 = ₹90

Using an 18% GST Calculator

An easy GST calculator saves time! Here’s how to use one:

- Enter the original price.

- Select 18% GST rate.

- Click “Calculate” to see GST and total.

Try this example:

Original Price: ₹25,000

GST: ₹4,500

Total: ₹29,500

Common Mistakes to Avoid

- Forgetting to Divide by 1.18 for Reverse Calculations:

Wrong: Total × 18% = GST (This gives incorrect GST).

Right: Use Total ÷ 1.18 first. - Assuming All Products Have 18% GST: Check GST rates for different items.

2025 GST Updates in India

As of 2025, the 18% GST rate remains unchanged for electronics, textiles, and IT services. The GST Council has simplified filing processes, making it easier for small businesses.

18% GST Calculation Examples

| Original Price (₹) | GST (18%) (₹) | Total Price (₹) |

|---|---|---|

| 1,000 | 180 | 1,180 |

| 5,000 | 900 | 5,900 |

| 10,000 | 1,800 | 11,800 |

Also Read

FAQs Calculate 18% GST

Is GST always 18% in India?

No, GST has four slabs: 5%, 12%, 18%, and 28%. 18% applies to items like phones and AC restaurants.

How do I calculate 18% GST on ₹10,000?

GST = ₹10,000 × 0.18 = ₹1,800. Total = ₹11,800.

How to remove GST from ₹2,360?

Original Price = ₹2,360 ÷ 1.18 = ₹2,000. GST = ₹360.

Can I calculate GST without a calculator?

Yes! Multiply by 0.18 for GST or divide by 1.18 to remove it.

Does MRP include GST?

Yes, MRP is the final price with GST.

What’s the formula for GST?

GST Amount = Original Price × 18%. Total = Original + GST.

Why use a GST calculator?

It avoids errors and saves time for large calculations.

Are GST rules the same in all states?

Yes, GST is uniform across India.

What’s the GST on a ₹15,000 product?

GST = ₹15,000 × 0.18 = ₹2,700. Total = ₹17,700.

Is there GST on groceries?

Some groceries have 0% or 5% GST. Processed foods may have 18%.

Conclusion

Now you know how to calculate 18% GST like an expert! Use the formulas, try the easy GST calculator, and always double-check your work. With this knowledge, you’ll never overpay or get confused by prices again. Happy calculating!

Pingback: How Do You Calculate GST Included? A Complete Free Guide for 2025 - gstcalculatorpro.com