“Learn How Do You Calculate GST Included? with simple steps, examples, and an easy GST calculator. Master reverse GST calculations, understand 18% GST in rupees, and avoid common mistakes. Perfect for Indian taxpayers!”

Goods and Services Tax (GST) is a value-added tax used in India since 2017. But even in 2025, many people still struggle with questions like “How do you calculate GST included in a price?” or “How to remove GST from the total amount?” This guide breaks down GST calculations into simple steps, with examples, tables, and even an easy GST calculator method. Let’s dive in!

How Do You Calculate GST Included?

To calculate GST included in a price, use this formula:

GST Amount = Total Price × (GST Rate / (100 + GST Rate)).

Example:

If a product costs ₹1,180 (including 18% GST):

- GST Amount = 1,180 × (18/118) = ₹180

- Original Price = ₹1,180 – ₹180 = ₹1,000.

For quick calculations:

- Divide the total amount by (1 + GST rate) to find the original price.

- Subtract the original price from the total to get the GST.

Ideal for bills, receipts, or MRP!

What is GST?

GST is a single tax that replaced multiple indirect taxes like VAT, service tax, and excise duty. It’s charged on the supply of goods and services and is divided into five tax slabs: 0%, 5%, 12%, 18%, and 28%.

Basic Formula to Calculate GST

The formula to calculate GST is straightforward:

GST Amount = Original Cost × (GST Rate / 100)

Total Price = Original Cost + GST Amount

Example:

If a shirt costs ₹1,000 and GST is 5%,

- GST Amount = ₹1,000 × (5/100) = ₹50

- Total Price = ₹1,000 + ₹50 = ₹1,050

How to Calculate GST on MRP (Maximum Retail Price)

MRP is the maximum price a product can be sold to the customer, including GST. To find the GST amount:

Step 1: Identify the GST rate (e.g., 18%).

Step 2: Use the formula:

GST Amount = MRP × (GST Rate / (100 + GST Rate))

Example:

A book has an MRP of ₹236 with 18% GST.

- GST Amount = ₹236 × (18/118) = ₹36

- Original Cost = ₹236 – ₹36 = ₹200

How to Remove GST from Total Amount (Reverse Calculation)

Need to separate GST from the total price? Use the reverse GST calculation formula:

Original Cost = Total Amount / (1 + (GST Rate / 100))

Example:

You paid ₹1,180 for a gadget (18% GST included).

- Original Cost = ₹1,180 / 1.18 = ₹1,000

- GST Amount = ₹1,180 – ₹1,000 = ₹180

How Do You Calculate GST Included in India?

In India, GST is split into CGST (Central GST) and SGST (State GST) for intra-state sales. For inter-state sales, IGST (Integrated GST) applies.

Example (Intra-State Sale):

A Delhi shop sells a chair for ₹2,000 with 18% GST.

- CGST = 9% of ₹2,000 = ₹180

- SGST = 9% of ₹2,000 = ₹180

- Total GST = ₹360

- Total Price = ₹2,000 + ₹360 = ₹2,360

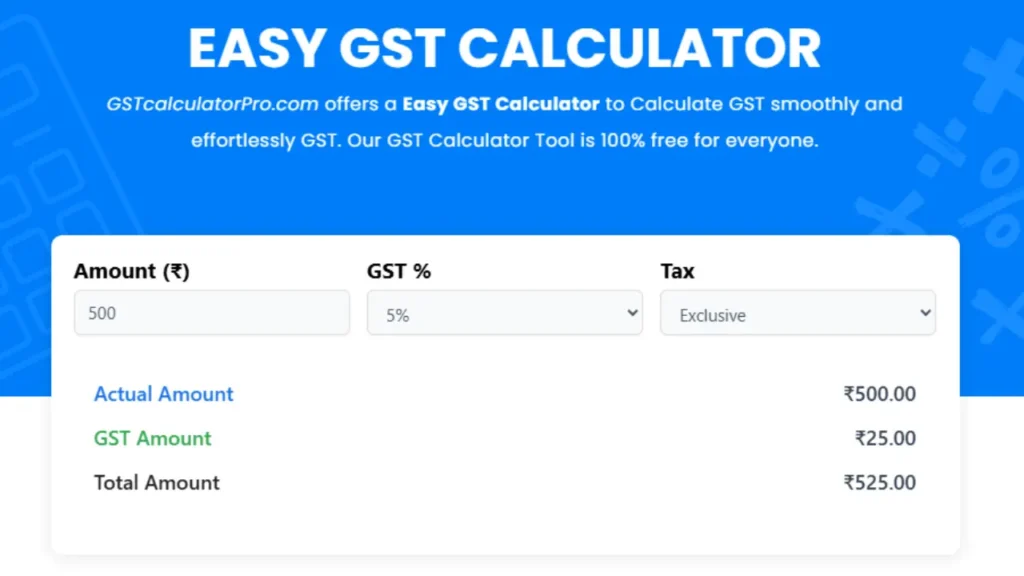

Using an Easy GST Calculator

An easy GST calculator simplifies the math. Here’s how to use one:

- Enter the original price or MRP.

- Select the GST rate (e.g., 18%).

- Click “Calculate” to get the GST amount and total price.

Reverse GST Calculation Formula Explained

The reverse formula helps when only the final price is known:

Original Cost = Total Price / (1 + (GST Rate / 100))

GST Amount = Total Price – Original Cost

Example:

Total Price = ₹590 (with 18% GST).

- Original Cost = ₹590 / 1.18 = ₹500

- GST Amount = ₹590 – ₹500 = ₹90

18% GST in Rupees: Practical Examples

The 18% GST slab applies to items like smartphones, ACs, and processed foods.

Example 1:

A mixer priced at ₹5,000 + 18% GST:

- GST = ₹5,000 × 0.18 = ₹900

- Total Price = ₹5,900

Example 2:

Total bill for shoes = ₹2,360 (18% GST included).

- Original Cost = ₹2,360 / 1.18 = ₹2,000

- GST Paid = ₹360

GST Rates in India (2025 Update)

Here’s the latest GST slab structure:

| GST Rate | Common Items |

|---|---|

| 0% | Fresh vegetables, milk, eggs |

| 5% | Tea, spices, packaged curd |

| 12% | Butter, cheese, sewing machines |

| 18% | Hair oil, smartphones, biscuits |

| 28% | Luxury cars, ACs, aerated drinks |

Step-by-Step Guide to Calculate GST

Scenario: Buying a Laptop

- Original Price: ₹45,000

- GST Rate: 18%

- GST Amount: ₹45,000 × 0.18 = ₹8,100

- Total Price: ₹45,000 + ₹8,100 = ₹53,100

Common GST Calculation Mistakes to Avoid

- Using the wrong GST rate: Check the latest 2025 slab for your product.

- Forgetting to split CGST/SGST: For intra-state sales, divide the GST rate by 2.

- Miscalculating reverse GST: Always divide by (1 + GST rate), not multiply.

Try Our Free Online GST Tools

FAQs: Your GST Questions Answered

What is GST?

GST is a tax on goods and services applied at every stage of production.

How do I calculate GST from the total amount?

Use the formula:

Original Cost = Total Amount / (1 + GST Rate)

Is there an easy GST calculator online?

Yes! Search for “easy GST calculator” to find free tools.

How to remove 18% GST from ₹2,000?

Original Cost = ₹2,000 / 1.18 = ₹1,694.91

What is the reverse GST formula?

Original Cost = Total Price / (1 + GST Rate)

Are GST rates the same across India?

Yes, but CGST/SGST applies within a state, and IGST for inter-state sales.

How is GST calculated on MRP?

GST Amount = MRP × (GST Rate / (100 + GST Rate))

What items have 28% GST?

Luxury cars, aerated drinks, and high-end electronics.

Can I calculate GST without a calculator?

Yes, use the formulas shared in this guide.

Why is GST important?

It simplifies taxation, reduces corruption, and unifies India’s market.

Conclusion

Calculating GST doesn’t have to be confusing. With the formulas, examples, and easy GST calculator tips above, you can quickly figure out how much GST is included in a price or remove it from a total amount. Whether you’re a student, business owner, or shopper, this guide makes GST math simple!

Pro Tip: Bookmark this page for quick access to GST formulas and examples!