Learn how to calculate GST with easy steps, Excel formulas, and examples. Understand 18% GST, MRP calculations, and reverse GST methods. Avoid common mistakes!

Goods and Services Tax (GST) is a unified tax system in India that replaced multiple indirect taxes like VAT, service tax, and excise duty. Introduced in 2017, GST is divided into five tax slabs: 0%, 5%, 12%, 18%, and 28%. Understanding how to calculate GST is essential for businesses, students, and even everyday shoppers to avoid overpaying or underpaying taxes.

GST simplifies tax compliance, reduces cascading taxes, and ensures transparency. Whether you’re billing a customer or checking an MRP label, knowing GST calculations helps you stay informed.

Basic GST Calculation Methods

Purpose: To determine the GST amount and total price from the base price.

Formula:

- GST Amount = Base Price × (GST Rate / 100)

- Total Price = Base Price + GST Amount

Example: - Base Price = ₹10,000, GST = 18%

- GST = ₹10,000 × 0.18 = ₹1,800

- Total = ₹10,000 + ₹1,800 = ₹11,800

Tip: Always verify the GST slab (e.g., 5%, 12%, 18%) applicable to your product/service.

How Do You Calculate 18% GST?

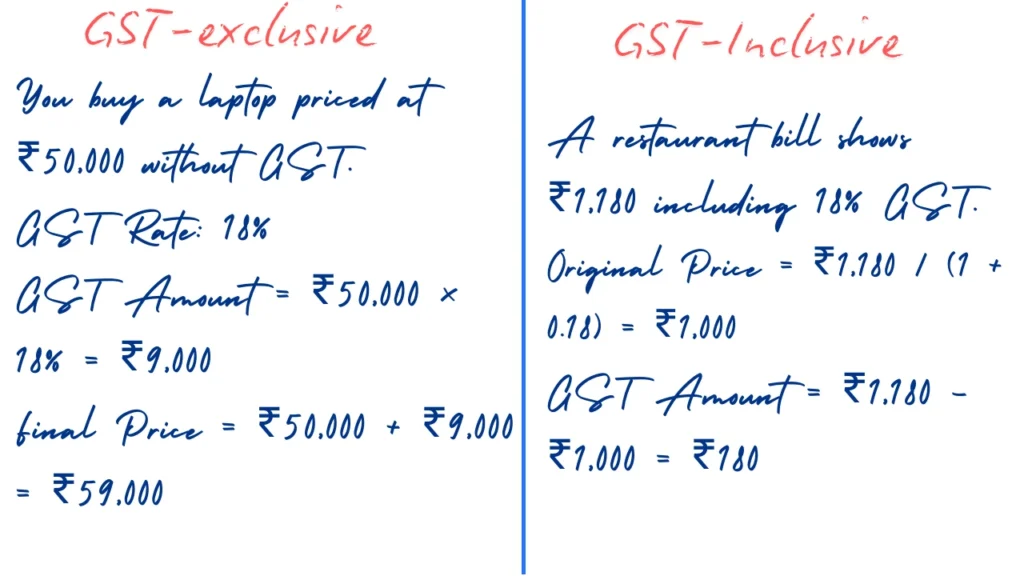

Let’s say you buy a laptop worth ₹50,000 with an 18% GST rate.

- GST Amount = ₹50,000 × 18% = ₹9,000

- Total Price = ₹50,000 + ₹9,000 = ₹59,000

Formula:GST=Base Price×(GST Rate100)GST=Base Price×(100GST Rate)

How Do You Calculate GST in Numbers?

For a product priced at ₹1,200 with 12% GST:

- GST = ₹1,200 × 0.12 = ₹144

- Total = ₹1,200 + ₹144 = ₹1,344

Calculating GST-Inclusive Prices

Purpose: To extract the GST amount and base price from a total price that includes GST.

Formula:

- Base Price = Total Price / (1 + GST Rate/100)

- GST Amount = Total Price – Base Price

Example: - Total Price = ₹1,180 (including 18% GST)

- Base Price = ₹1,180 / 1.18 = ₹1,000

- GST = ₹1,180 – ₹1,000 = ₹180

Application: Use this to verify MRP labels or invoices.

How Do You Calculate GST Included?

If a product’s MRP is ₹1,180 (including 18% GST), here’s how to find the base price:

- Base Price = ₹1,180 ÷ 1.18 = ₹1,000

- GST Amount = ₹1,180 – ₹1,000 = ₹180

Formula for GST-Inclusive Prices:Base Price=Total Price1+(GST Rate100)Base Price=1+(100GST Rate)Total Price

How to Calculate GST Included in MRP?

Example: A shampoo bottle’s MRP is ₹236 (including 18% GST).

- Base Price = ₹236 ÷ 1.18 = ₹200

- GST = ₹200 × 18% = ₹36

Using Excel for GST Calculations

Purpose: Automate GST computations for efficiency and accuracy.

Formulas:

- Base Price from Total:

=A1/(1+B1)(e.g., ₹1,416 ÷ 1.18 = ₹1,200) - GST Amount:

=A1 - (A1/(1+B1))(e.g., ₹1,416 – ₹1,200 = ₹216)

Tip: Use cell references (e.g., B1 for GST rate) to dynamically update calculations when inputs change.

How to Calculate GST on MRP in Excel?

How to Calculate GST on MRP in Excel? Free Guide in 2025

- Enter the MRP in Cell A1 (e.g., ₹1,416).

- In Cell B1, enter the GST rate as 18%.

- To find the base price:

- Formula:

=A1 / (1 + B1)→ ₹1,416 / 1.18 = ₹1,200.

- Formula:

- GST Amount:

=A1 - (A1 / (1 + B1))→ ₹1,416 – ₹1,200 = ₹216.

Reverse GST Calculations

Purpose: Find the GST amount when only the total price is known.

Formula:

- GST = (Total Price × GST Rate) / (100 + GST Rate)

Example: - Total = ₹2,360 (18% GST)

- GST = (₹2,360 × 18) / 118 = ₹360

Use Case: Verify GST charged on bills or receipts.

How to Calculate Excluding GST?

If the total price is ₹944 (including 12% GST):

- Base Price = ₹944 ÷ 1.12 = ₹843 (rounded)

- GST = ₹944 – ₹843 = ₹101

How Do You Calculate GST from a Number?

Example: Total price = ₹2,360 (including 18% GST).

- GST = (₹2,360 × 18) / 118 = ₹360

How Do You Calculate Off on MRP?

Suppose a jacket with MRP ₹2,000 has a 20% discount:

- Discount = ₹2,000 × 20% = ₹400

- Price after discount = ₹1,600

- GST (18%) = ₹1,600 × 18% = ₹288

- Final Price = ₹1,600 + ₹288 = ₹1,888

How to Calculate Taxable Amount?

Taxable Amount = MRP – Discounts + Additional Charges

- Using the wrong GST slab: Verify rates for your product category.

- Ignoring reverse calculations: Always check if MRP includes GST.

- Miscalculating discounts: Apply GST after deducting discounts.

GST Rates in India

| Category | GST Rate |

|---|---|

| Essential Goods | 0% |

| Processed Foods | 5% |

| Electronics | 18% |

| Luxury Items | 28% |

FAQs

How do I calculate 18% GST on ₹10,000?

GST = ₹10,000 × 0.18 = ₹1,800. Total = ₹11,800.

How to remove GST from total price?

Divide the total by (1 + GST rate). E.g., ₹1,180 ÷ 1.18 = ₹1,000

Can Excel calculate GST automatically?

Yes! Use formulas like =A1*18% for GST or =A1/1.18 for base price.

How is GST calculated on discounted MRP?

Apply GST after deducting the discount. E.g., ₹1,000 – ₹200 = ₹800. GST = ₹800 × 18% = ₹144.

What’s the formula for taxable value?

Taxable Value = (MRP – Discounts) + Other Charges.

How to check if GST is included in MRP?

Look for “Inclusive of all taxes” on the label.

Is GST the same nationwide?

Yes, GST rates are uniform across India.

Conclusion

Understanding how to calculate GST is a vital skill for businesses, consumers, and taxpayers in India. Whether you’re determining the tax on a new purchase, verifying an invoice, or managing business finances, the formulas and methods covered in this guide simplify the process. From calculating 18% GST to figuring out GST from total prices, these steps ensure accuracy and compliance with India’s tax system.

By mastering tools like Excel for GST calculations and learning to reverse-calculate GST-inclusive MRP, you can avoid common errors and make informed financial decisions. Remember, GST is uniform across India, and its transparent structure helps eliminate hidden taxes, fostering trust in everyday transactions.

For businesses, accurate GST calculations are critical for filing returns, claiming Input Tax Credit (ITC), and avoiding penalties. For shoppers, it empowers you to verify if the GST charged on bills aligns with the MRP.

If you’re still unsure, revisit the FAQs or use free online GST calculators to cross-check your numbers. With practice, these calculations will become second nature, saving you time and money in the long run.

Stay updated with GST rate changes and keep this guide handy for quick reference. Happy calculating! 💡

Also Read:

How To File GST Returns Online Easily and Securely in 2025

Pingback: How is GST Included in MRP? In 2025 - gstcalculatorpro.com

Pingback: How to Calculate GST Easily: A Step-by-Step Guide for Businesses and Individuals – GST Calculator