Learn how to claim GST refund in 2025, understand ITC eligibility, the 180-day rule, and more. A complete guide for businesses and taxpayers in India

Navigating the GST refund process can feel overwhelming, especially if you’re new to the system. But don’t worry! This guide breaks down everything you need to know about claiming GST refunds, from eligibility criteria to calculating Input Tax Credit (ITC) and avoiding common mistakes. Let’s dive in!

Who Can Claim a Refund in GST?

Not everyone is eligible for a GST refund. Here’s a list of individuals and businesses who can claim it:

- Exporters: Businesses exporting goods or services under a zero-rated supply.

- Unregistered Buyers: If a buyer isn’t registered under GST but pays tax (e.g., under reverse charge).

- Tax Paid by Mistake: Excess tax paid due to errors or miscalculations.

- Refund for International Tourists: Foreign tourists claiming refunds on purchases made in India.

- Inverted Duty Structure: When the tax rate on inputs is higher than the output tax rate.

What is Eligible ITC in GST?

Input Tax Credit (ITC) is the credit businesses receive for taxes paid on purchases. Eligible ITC includes:

- Taxes paid on raw materials, services, or capital goods used for business.

- Taxes paid under reverse charge.

- Taxes on inputs used to make taxable or zero-rated supplies.

Non-Eligible ITC:

- Personal use purchases.

- Goods lost, stolen, or destroyed.

- Membership fees for clubs or health centers.

Example: If you buy ₹1 lakh worth of raw materials with 18% GST (₹18,000), you can claim ₹18,000 as ITC.

How is ITC Calculated in GST?

Calculating ITC involves three steps:

- Determine Total Eligible Purchases: Sum up all GST-paid purchases related to business.

- Verify GST Invoices: Ensure invoices have GSTIN, tax rates, and other details.

- Adjust for Ineligible Credits: Subtract non-eligible ITC (e.g., blocked credits).

Formula:

Total ITC = (Eligible Purchases × GST Rate) – Non-Eligible ITC

Can GST ITC Be Refunded?

Yes, but only in specific cases:

- Exports: Refund for zero-rated supplies.

- Inverted Duty Structure: Higher input tax than output tax.

- Accumulated ITC: Due to provisional assessment or court orders.

Note: Regular taxpayers can’t refund ITC unless they fall under the above categories.

How to Check Your GST Balance

Follow these steps to check your GST cash and ITC balance:

- Visit GST Portal (www.gst.gov.in).

- Login with your credentials.

- Go to ‘Services’ > ‘Ledgers’ > ‘Electronic Cash Ledger’ (for cash balance) or ‘Electronic Credit Ledger’ (for ITC balance).

What is the 180-Day Rule in GST?

If you’re a recipient of goods/services, you must ensure your supplier files their GST returns and pays taxes within 180 days from invoice date. If they fail:

- You must reverse the ITC claimed.

- Pay interest (18% p.a.) on the reversed amount.

Example: If you claimed ₹10,000 ITC but the supplier didn’t pay taxes in 180 days, reverse ₹10,000 + ₹1,500 interest.

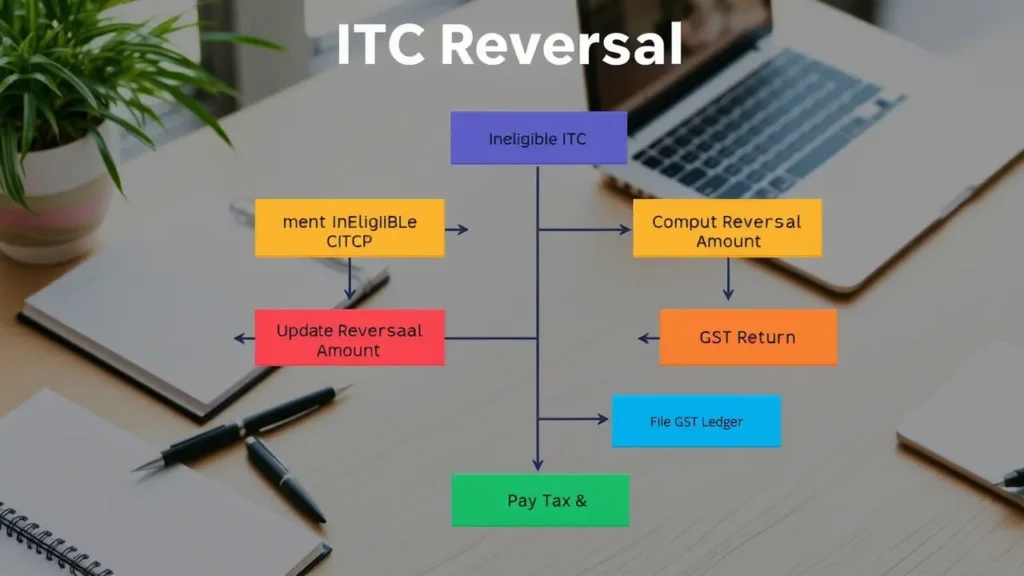

How to Reverse ITC in GST

Reversing ITC is required in cases like non-payment by suppliers or ineligible claims. Here’s how:

- GSTR-2B/2A: Compare your ITC claims with supplier-filed GSTR-1.

- Adjust in GSTR-3B: Report reversed ITC in Table 4(B)(1).

- Pay Interest: If applicable, calculate and pay interest via DRC-03.

How to Claim GST Refund?

Follow this Simple 5 Steps to Claim GST Refund easily

Step 1: Determine Eligibility

Check if your case falls under refund categories (exports, inverted duty, etc.).

Step 2: File Required Forms

- FORM GST RFD-01: Main refund application.

- FORM GST RFD-01A: For provisional refunds (exports).

Step 3: Submit Documents

- Invoices, bank statements, BRC/FIRC (for exports).

- Declaration of no unjust enrichment.

Step 4: Track Application

Use ARN number on the GST portal to track refund status.

Step 5: Receive Refund

Refunds are credited to your bank account within 60 days.

Watch this Video for Better understanding How to Claim GST Refund in 2025?

Common Mistakes to Avoid

- Missing deadlines (2 years from relevant date).

- Incorrect ITC calculations.

- Not reconciling GSTR-2A/2B.

GST Refund Process in 2025

- Faster Refunds: Automated processing for exporters via ICEGATE integration.

- New ITC Restrictions: Blocked credits expanded to include CSR activities.

GST Refund Timelines

| Refund Type | Processing Time |

|---|---|

| Export Refunds | 15-30 days |

| Inverted Duty Refunds | 45-60 days |

| Provisional Refunds | 7-10 days |

Also Read

- How to Cancel GST Registration in 2025

- Master GST Calculations in 5 Minutes

- How to Apply for ISD Registration Under GST? In 2025

FAQs: How to Claim GST Refund

What is the time limit to claim a GST refund?

2 years from the relevant date (e.g., date of export).

Can I claim GST refund if I forgot to file GSTR-1?

No, filing GSTR-1 and GSTR-3B is mandatory.

Is interest paid on delayed refunds?

Yes, 6% p.a. after 60 days of application.

What is ‘unjust enrichment’ in GST refunds?

Proving the tax burden wasn’t passed to customers.

How to correct errors in a refund application?

File an amendment request via FORM GST RFD-01.

Can I claim GST refund if my business registration is canceled?

Yes, file within 2 years of cancellation using FORM GST RFD-01.

What happens to my GST refund if my business is closed?

Submit closure proof and final returns to claim within 2 years.

Are there special documents for export refunds?

Yes, BRC/FIRC, shipping bills, and export invoices.

Can foreign taxpayers claim GST refunds?

Yes, through an appointed Indian agent.

What if my refund is delayed beyond 60 days?

Escalate via grievance portal; interest at 6% applies.

Try Our Free Online GST Tools

Conclusion

Figuring out how to claim GST refund might feel like solving a puzzle at first, but once you know the rules, it’s like following a recipe! Start by checking if you qualify—exporters, businesses with inverted tax rates, or even those who paid extra tax by mistake can apply. The key is to stay on top of ITC calculations and stick to the 180-day rule to avoid losing credits or facing penalties. Make it a habit to log into the GST portal regularly to check your balance and confirm your suppliers are filing returns promptly.

In 2025, the GST system introduced smoother processes, like quicker refunds for exporters and tighter ITC rules. These updates mean you need to keep your paperwork razor-sharp. For instance, if a supplier delays payments, reverse your ITC claims quickly to dodge interest charges. Tools like GSTR-2A/2B reconciliation are your best friends here—they help spot errors before they snowball.

Success boils down to three things: knowing your eligibility, double-checking details, and meeting deadlines. Treat refunds as a regular part of your GST routine, not a headache. Use the GST portal’s tracking features, and don’t shy away from asking a tax expert for help if things get tricky. With a little diligence, you’ll turn refunds into a seamless part of your financial workflow, keeping your business’s cash flow healthy and stress-free!

Pingback: What Happens If GST Is Not Filed? Free Guide In 2025 - gstcalculatorpro.com