Learn how to find GST State Code for invoicing in 2025. Includes GST invoice tips, state lookup, easy GST calculator, and compliance guide for businesses in India.

If you are running a business or are self-employed in India, then you already know how important GST (Goods and Services Tax) has become in daily invoicing. In 2025, GST compliance is stricter than ever. Whether you are sending invoices to clients or filing tax returns, understanding how to find GST State Code is very important. Without the correct GST state code in your invoice, it may become invalid or even face penalties.

In this article, we will explain everything you need to know about how to find GST state code in 2025. We will also explain how it affects GST invoicing 2025, share useful GST invoice tips, guide you with business invoicing steps, and show how to use an easy GST calculator. If you’re a small business owner, freelancer, or accountant, this article is a full business invoicing guide for you.

What is a GST State Code and Why is It Important for GST Invoicing 2025?

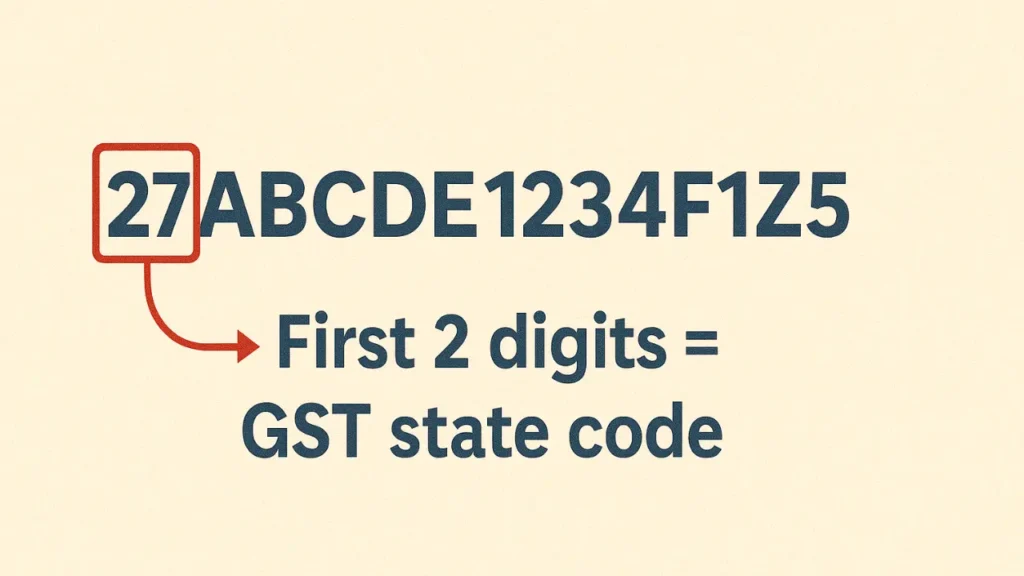

The GST state code is a two-digit number that represents a state or union territory in India. This code is used in GST numbers (GSTIN), invoices, and GST returns. In GSTIN, the first two digits are the GST state code.

For example:

- GSTIN: 27ABCDE1234F1Z5

- Here, 27 is the state code for Maharashtra.

Importance of GST State Code:

- Helps identify the origin and destination of a transaction.

- Determines whether a supply is inter-state (IGST) or intra-state (CGST & SGST).

- Mandatory for GST compliance and registration.

- Prevents errors during GST filing and invoicing.

- Avoids penalties due to wrong GST entries.

How to Find GST State Code Easily in 2025

Many people think it is difficult to find GST state code. But actually, it is very easy if you follow a simple method. You can find GST codes from multiple trusted sources.

1. State GST Lookup

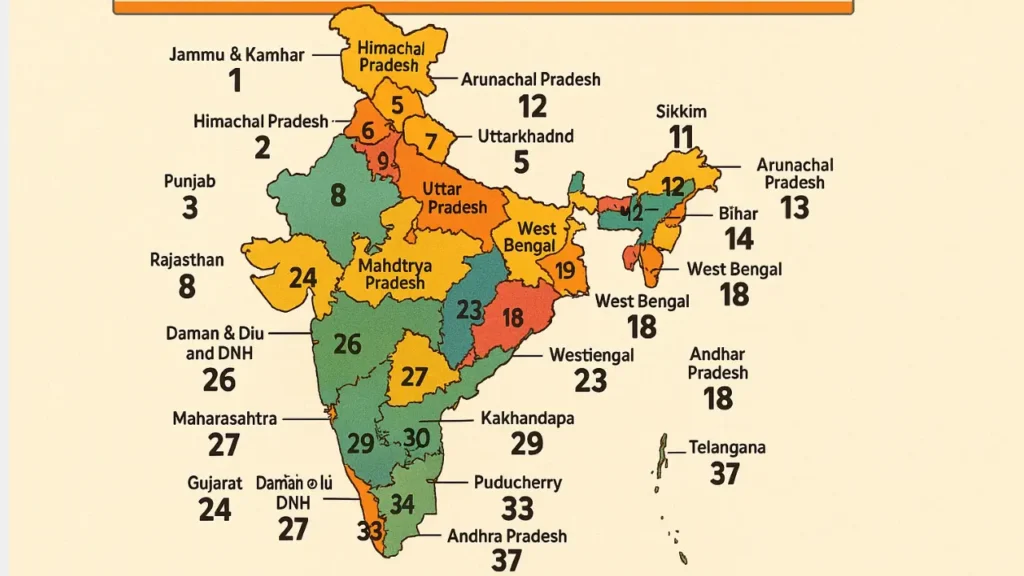

Here is a full list of GST state codes for 2025:

| State/UT | Code |

|---|---|

| Jammu & Kashmir | 01 |

| Himachal Pradesh | 02 |

| Punjab | 03 |

| Chandigarh | 04 |

| Uttarakhand | 05 |

| Haryana | 06 |

| Delhi | 07 |

| Rajasthan | 08 |

| Uttar Pradesh | 09 |

| Bihar | 10 |

| Sikkim | 11 |

| Arunachal Pradesh | 12 |

| Nagaland | 13 |

| Manipur | 14 |

| Mizoram | 15 |

| Tripura | 16 |

| Meghalaya | 17 |

| Assam | 18 |

| West Bengal | 19 |

| Jharkhand | 20 |

| Odisha | 21 |

| Chhattisgarh | 22 |

| Madhya Pradesh | 23 |

| Gujarat | 24 |

| Daman & Diu and Dadra | 26 |

| Maharashtra | 27 |

| Andhra Pradesh (Before split) | 28 |

| Karnataka | 29 |

| Goa | 30 |

| Lakshadweep | 31 |

| Kerala | 32 |

| Tamil Nadu | 33 |

| Puducherry | 34 |

| Andaman & Nicobar Islands | 35 |

| Telangana | 36 |

| Andhra Pradesh (After split) | 37 |

| Ladakh | 38 |

2. How to Use GST Code Search Tools

There are several websites and apps where you can do a GST code search by state name. Just enter the state name and it will show you the correct GST state code. Some government portals and GST software like ClearTax, Zoho, and Tally also have this feature.

3. GST Number Check for Code

You can also check the GST number (GSTIN) of any business. The first two digits in GSTIN will tell you the GST state code. For example:

- GSTIN: 09ABCDF4567P1Z6 → 09 = Uttar Pradesh

Try Our Free Online GST Tools

GST Invoicing 2025: How the State Code Impacts Your Invoice

Your GST invoice must contain the correct GST state code. Otherwise, it will be rejected by your buyer or during GST filing. Here are the key fields in a GST invoice where state code plays a role:

- Supplier’s GSTIN with correct state code.

- Place of supply with correct state name and code.

- Tax type (IGST vs CGST+SGST) depends on state code.

Example:

- You are in Maharashtra (27), and your customer is in Delhi (07).

- Since it is inter-state, you charge IGST.

Wrong state code = Wrong tax = Penalty!

GST Invoice Tips for 2025: Common Mistakes to Avoid

✅ Always double-check the GSTIN of your buyer.

✅ Use correct state code in your own GSTIN.

✅ Use reliable software for invoicing and GST compliance.

✅ Mention place of supply clearly with correct state.

❌ Never guess a GST code; use state GST lookup tools.

How to Register and Stay Compliant

Before you start invoicing with GST codes, you must be registered under GST. Here’s how to do it step-by-step in 2025:

Step 1: GST Registration

- Visit the GST portal

- Fill application with business details

- Add state, PAN, Aadhaar, and business documents

- Receive GSTIN with state code in 7 days

Step 2: Create GST Compliant Invoices

- Use billing software or templates

- Include all necessary fields: buyer info, seller info, GSTIN, HSN/SAC codes, tax breakdown

Step 3: File GST Returns Monthly/Quarterly

- Use the correct state code while filing GSTR-1, GSTR-3B, etc.

Easy GST Calculator for Invoicing

Many people find it hard to calculate GST. But with an easy GST calculator, you can simply enter your product amount and tax rate. The calculator will show CGST, SGST, IGST, and total invoice value.

Example:

- Product Value: ₹1000

- GST Rate: 18%

- If intra-state: ₹90 CGST + ₹90 SGST

- If inter-state: ₹180 IGST

You can find such calculators online or in accounting software.

GST Code Search in Different Scenarios

There are different ways you may need to find GST state code:

✅ During new GST registration

✅ When receiving invoice from supplier

✅ While verifying customer GSTIN

✅ Before filing GSTR returns

So knowing how to do a proper GST code search is very useful in daily business activities.

GST Compliance: Why It Matters in 2025

The government is using AI and automation to check invoices and returns. Any mismatch in GST state code will be detected quickly. That’s why being GST compliant is a must in 2025.

Non-compliance can lead to:

- Rejection of invoice by client

- Penalties and fines

- GSTIN cancellation

- Legal notices

So keep your invoicing clean, correct, and compliant!

FAQs

What is a GST state code?

GST state code is the first two digits of a GSTIN which shows the state of the taxpayer.

How can I find GST state code?

Use a GST code search table, check GSTIN, or use state lookup tools.

What is the GST code for Maharashtra?

The GST code for Maharashtra is 27.

Can I use the wrong state code in GSTIN?

No, it will lead to invoice rejection and penalties.

What happens if I forget to include state code in invoice?

Invoice will be invalid for GST filing.

How to check GST number for state code?

Just look at the first two digits of GSTIN.

Where can I use an easy GST calculator?

Is state GST lookup available on mobile?

Yes, many apps and websites offer this feature.

Do freelancers need to know GST state codes?

Yes, especially if they are invoicing businesses.

How often should I check GST codes?

Before invoicing new clients or filing returns.

Conclusion

Finding and using the correct GST state code is very important for GST compliance and smooth business invoicing in 2025. With digital tools, easy calculators, and state lookup tables, it has become simple to stay updated. Always check your GSTIN, use correct codes in your invoices, and stay compliant with GST rules. It will save you from many legal troubles and keep your business running smoothly.

Start using GST codes correctly from today itself — your future self will thank you!

ALSO READ