Discover the updated HSN codes 2025 with GST rates. This complete HSN list offers a detailed GST rate guide, product classification tips, and compliance insights for businesses.

The year 2025 brings with it many updates in the world of taxation, especially when it comes to the HSN codes 2025 and GST (Goods and Services Tax) rates. Every business, whether small or big, needs to follow these codes and rates properly to ensure GST compliance. If you are a shop owner, wholesaler, service provider, or manufacturer, this article is a complete guide to help you understand the updated HSN codes, their purpose, and how to apply them in your business operations.

HSN (Harmonized System of Nomenclature) is a global system used for classifying goods. India follows this system to identify different products and apply the correct GST rates. In 2025, the government has made several changes to improve clarity and make tax collection more streamlined.

What is HSN Code and Why It Matters in 2025?

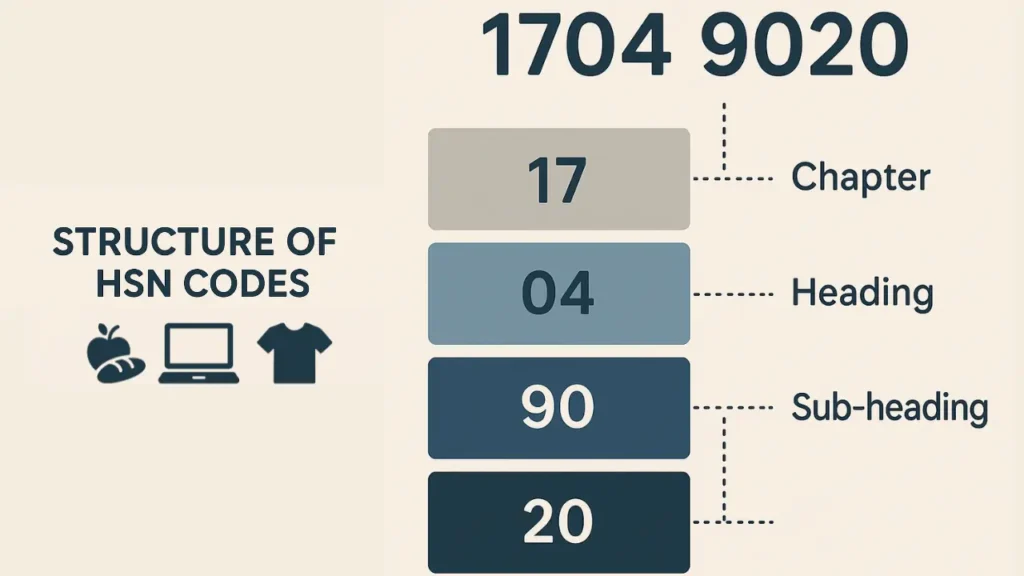

HSN codes are used for identifying and classifying goods in a standard way. Every product has a specific HSN code, and based on that code, the GST rate is decided. For example, milk has a different HSN code than a mobile phone, and both have different GST rates. These codes make it easier for businesses and the government to handle taxation.

In 2025, the HSN codes 2025 have been updated with more clarity, better categorization, and ease for small businesses. These updates help avoid confusion, save time during filing GST returns, and reduce the chances of making errors in invoices.

Major Updates in HSN Codes for 2025

The Government of India has released the GST update 2025 which includes new rules and revised tax code list. Here are the main highlights:

- New HSN codes for electronics, organic items, and eco-friendly products.

- Revised codes for food items, textiles, and machinery.

- Introduction of sub-classification for items like cosmetics and personal care.

- Greater focus on digitization with QR codes for easy verification.

These changes aim to make the product classification process smoother and bring uniformity across businesses.

Examples of Updated HSN Codes in 2025

| Product Category | Updated HSN Code | GST Rate |

|---|---|---|

| Smartphones | 8517.12.00 | 12% |

| Organic Rice | 1006.30.10 | 5% |

| Solar Panels | 8541.40.11 | 5% |

| Herbal Cosmetics | 3304.99.10 | 18% |

| Leather Shoes | 6403.59.00 | 18% |

Easy GST Calculator: Simplify Your Tax Calculation

Calculating GST can be confusing for many people. That’s why the Government has launched and promoted the use of Easy GST Calculator tools online. These tools allow businesses and individuals to calculate their GST based on the HSN codes 2025 and applicable rates.

Steps to use the Easy GST Calculator:

- Enter product price.

- Select product type or HSN code.

- Choose the GST rate.

- The calculator shows CGST, SGST, and total price.

Using such tools not only saves time but also ensures GST compliance during billing and filing.

Try Our Free Online GST Tools

Complete HSN List 2025: Key Categories Explained

Let us now look at the complete HSN list in 2025 with simplified descriptions. These categories cover most goods used in daily life and industries.

1. Agricultural Goods

Items like rice, wheat, pulses, vegetables, and animal feed have their unique codes. Most of these fall under 0% or 5% GST bracket.

2. Textiles and Garments

Clothing items, yarn, fabrics, and accessories come under this section. HSN codes in this category have been updated in 2025 for better clarity on synthetic vs natural materials.

3. Electronics

Mobile phones, laptops, wires, batteries, and smart devices. New sub-codes introduced for smart wearables and IoT devices.

4. Machinery and Tools

Machinery used in farming, construction, and industry. Separate codes for imported vs. locally manufactured tools.

5. Household Goods

Furniture, kitchen appliances, cleaning products now have detailed classification.

GST Rate Guide for 2025: Slabs and Applications

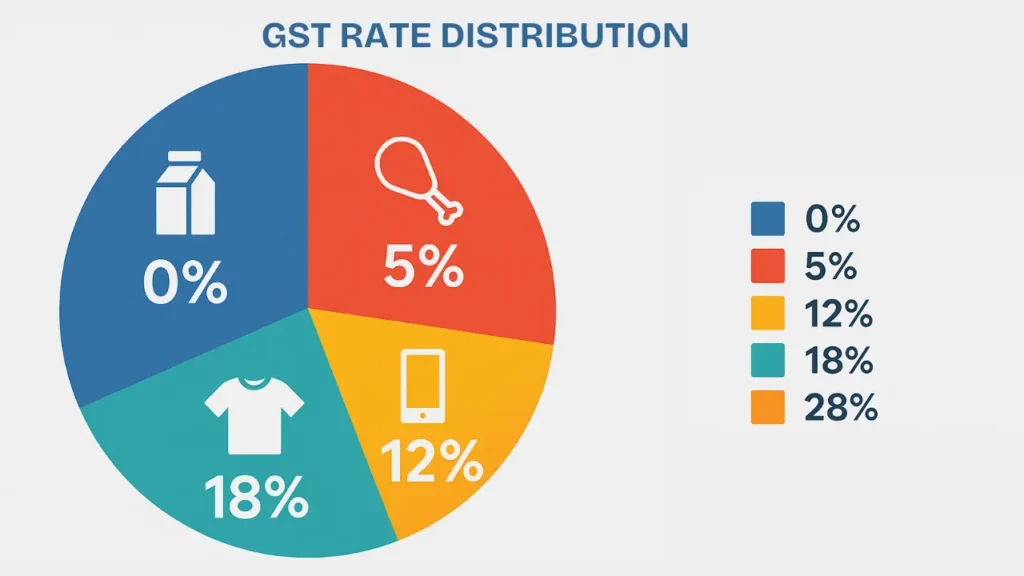

In 2025, the GST Council has retained the existing four main GST slabs:

- 0% GST – Essential items like fresh fruits, vegetables, milk.

- 5% GST – Processed food, footwear under Rs. 1000, fertilizers.

- 12% GST – Mobile phones, juices, spectacles.

- 18% GST – Refrigerators, cosmetics, soaps.

- 28% GST – Luxury cars, tobacco, aerated drinks.

GST compliance means charging the correct GST rate and mentioning the HSN codes 2025 on invoices and returns.

Understanding Product Classification in 2025

Product classification means placing a product under the right HSN code and GST rate. In 2025, with updates in HSN reference, it has become easier. Every item now has a detailed explanation in the GST portal for proper classification.

Mistakes in classification can lead to penalties, so it is very important to:

- Refer to government-issued GST rate guide.

- Use digital tools for business HSN search.

- Check latest notifications on GST update websites.

Also Read

GST Compliance Made Easy for Businesses

Following GST rules is very important for every business. In 2025, the government has made things simpler by offering support like:

- HSN-based billing software.

- GST portal auto-validation for codes.

- Easy GST Calculator for all traders.

Whether you are a local kirana store or an e-commerce seller, using the correct business HSN codes keeps your work smooth and legal.

How to Stay Updated with HSN Codes 2025?

To stay current with the updated HSN codes, you can:

- Subscribe to GST Council newsletters.

- Check the GST portal regularly.

- Follow news related to GST updates.

- Use apps that notify about changes in the tax code list.

This ensures you don’t miss important updates and continue to stay in GST compliance.

Conclusion

Understanding and using the correct HSN codes 2025 is now easier than before. With help from the complete HSN list, Easy GST Calculator, and proper product classification, businesses in India can follow the tax system smoothly. Always use official tools and references for error-free operations. Being informed about the GST rate guide will help every trader, entrepreneur, or tax consultant to stay ahead in 2025.

FAQ About HSN Codes and GST Rates 2025

What is an HSN code?

HSN stands for Harmonized System of Nomenclature. It is used to classify goods for GST.

How can I find my product’s HSN code in 2025?

Use the GST portal or the Easy GST Calculator to find the updated HSN code.

What are the GST rates in 2025?

The main rates are 0%, 5%, 12%, 18%, and 28% depending on the product.

Is it mandatory to mention HSN codes on invoices?

Yes, for GST-registered businesses, it’s mandatory.

Has the HSN list changed in 2025?

Yes, new categories and codes have been added.

Can I use the old HSN codes in 2025?

No, you must follow the updated HSN codes for 2025.

Where can I download the complete HSN list?

From the official GST portal.

What happens if I use the wrong HSN code?

You may face penalties or notices from the GST department.

Is there a mobile app for checking HSN codes?

Yes, there are many apps like GST Rate Finder and HSN Lookup.

Do service providers also need HSN codes?

No, they use SAC (Services Accounting Code), which is similar to HSN