Discover the latest updates to the union territory GST code in 2025. Understand the new GST rules, UT tax code, invoicing for UTs, and how these GST changes in India impact compliance.

In India, the Goods and Services Tax (GST) system has brought uniformity to indirect taxation across states and union territories. But, from time to time, changes happen to improve the system. One such major change in 2025 is the introduction of the new GST code for Union Territories. These updates are part of the GST policy update that the central government introduced to make compliance simpler, billing clearer, and taxation smoother for Union Territories (UTs).

The new union territory GST code impacts many areas like invoicing, calculation, compliance, and record-keeping. Whether you are a business owner, accountant, or even a consumer in any Union Territory like Delhi, Chandigarh, or Andaman and Nicobar Islands, this guide will help you understand all about the GST UT code 2025.

Why the GST Code Update Was Needed in 2025

The Government of India constantly works towards simplifying the tax system. One key reason for the GST code update in 2025 was to fix confusions around the previous UT codes, especially when it came to invoicing for UTs and GST compliance UT.

Before this update, many businesses in Union Territories faced issues due to outdated codes, incorrect mapping, and confusion during inter-state transactions. Errors in the UT tax code led to wrong GST filings, delays in refunds, and mismatch in returns.

Hence, the new 2025 GST update aims to:

- Provide unique and clearer GST codes for each Union Territory.

- Make the invoicing process faster and easier.

- Help in correct mapping of GST numbers.

- Improve overall compliance in UTs.

Updated Union Code and GST UT Code 2025

The heart of the 2025 GST update is the new set of codes assigned to Union Territories. These codes are now distinct, easy to remember, and digitally friendly. The update is part of the overall effort to align GST numbers better with geographical zones and simplify invoicing.

Here is the updated GST UT code 2025 for all Union Territories:

| Union Territory | Old GST Code | New GST Code (2025) |

|---|---|---|

| Andaman and Nicobar Islands | 35 | UT-AN35 |

| Chandigarh | 04 | UT-CH04 |

| Dadra & Nagar Haveli and Daman & Diu | 26 | UT-DD26 |

| Delhi | 07 | UT-DL07 |

| Jammu & Kashmir | 01 | UT-JK01 |

| Ladakh | 38 | UT-LK38 |

| Lakshadweep | 31 | UT-LW31 |

| Puducherry | 34 | UT-PY34 |

These codes are used in all GST-related filings, invoices, and return forms from April 1st, 2025.

How the New GST Rules Affect Invoicing for UTs

One of the most practical areas where the 2025 GST changes make a big difference is invoicing. Under the new GST rules:

- All invoices must include the updated union code.

- The new codes will automatically be pulled in most GST filing software.

- Invoices with old codes post-March 2025 may lead to errors or rejection in the GSTN system.

- QR codes used in digital GST invoices will also reflect the new UT codes.

This update ensures that businesses located in UTs or dealing with UTs use the correct UT tax code, avoiding errors that lead to penalties or GST return mismatches.

GST Compliance UT: What Businesses Must Do

For smooth GST compliance UT, businesses should:

- Update GST billing software with the new codes.

- Check if their GSTIN now reflects the new UT codes.

- Revise all invoice templates to include the new codes.

- Inform vendors, clients, and partners about the update.

- Train their accounting staff or CA team about these changes.

The government has also updated the GST portal to support the new union territory GST system. Hence, filing GSTR-1, GSTR-3B, and annual returns will now require the correct codes for successful submission.

How to Use an Easy GST Calculator for Union Territories

If you are confused about how to apply the new GST rates and codes for Union Territories, using an Easy GST Calculator can be a great help. These online tools have been updated to include the 2025 changes and support UT-specific calculations.

Here is how to use an Easy GST Calculator:

- Go to a reliable GST calculator website.

- Select your Union Territory GST location.

- Enter the taxable amount.

- Choose the applicable GST rate (5%, 12%, 18%, or 28%).

- Click calculate.

The calculator will instantly show the CGST, SGST/UTGST, and the total amount. Most calculators now show the updated union code along with the tax breakdown.

Try Our Free Online GST Tools

GST Changes India: Major Highlights for 2025

2025 brought several GST changes in India, not just for UTs but also for the whole country. However, UTs were given special focus due to their earlier complexities. Some major highlights include:

- New UT-specific codes as discussed.

- Simplified invoicing rules for UT businesses.

- Central GST portal update to accommodate UT-specific compliance needs.

- AI-powered GST helpdesk to assist with UT-specific queries.

- Unified GST training modules for UT-based small businesses.

These changes aim to bring Union Territories at par with states in terms of compliance and transparency.

Challenges Faced Before and How the GST Policy Update Solved Them

Before the 2025 GST policy update, Union Territories faced many challenges:

- Mismatches during GST reconciliation.

- Double taxation confusion.

- Lack of clarity on the UT tax code in returns.

- Outdated billing templates.

Thanks to the new update:

- Codes are standardized.

- The GSTN backend is synced with new UT identifiers.

- E-invoicing systems now support UT differentiation.

All these lead to better, faster, and easier compliance for businesses in UTs.

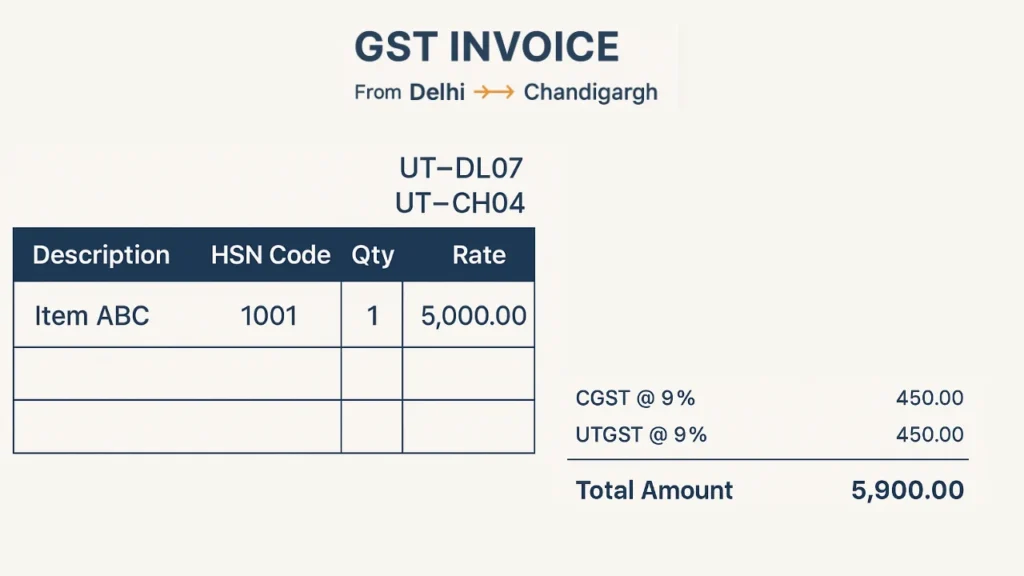

Practical Example: GST Billing from Delhi to Chandigarh

Imagine a business in Delhi is sending goods to a customer in Chandigarh. Here’s how invoicing works in 2025:

- The invoice will show UT-DL07 as the origin code.

- The destination will be UT-CH04.

- UTGST will apply instead of SGST.

- The Easy GST Calculator will show the correct UTGST share.

This avoids errors and ensures both businesses can claim ITC (Input Tax Credit) correctly.

What to Expect in the Future: GST Policy Roadmap Beyond 2025

The government is planning further reforms based on how the 2025 update performs. Expect:

- Monthly updates to UT-specific GST compliance guides.

- Smart AI tools to auto-validate invoices.

- State and UT GST integrations using blockchain.

- Better refund mechanisms using updated UT codes.

These steps will continue to simplify India’s GST system.

FAQs: Union Territory GST in 2025

What is the new GST code for Delhi?

The new code is UT-DL07, effective from April 1, 2025.

Will old UT codes work after 2025?

No, only new codes will be accepted in GST portal filings.

How do I update my billing software?

Contact your software provider or manually enter new UT codes in the settings.

What happens if I use the wrong UT tax code?

Your GST return may be rejected or attract penalties.

Is GST rate different for UTs?

No, rates remain the same, but UTGST applies instead of SGST.

Can I use an Easy GST Calculator for UTs?

Yes, most tools now support new UT codes.

Do I need to re-register for GST with the new code?

No, your existing GSTIN will be auto-mapped to the new code.

Where can I find the updated union code list?

It’s available on the official GST portal and in this article.

How will this affect GST refunds?

It will speed up refunds by reducing code mismatches.

Are these codes permanent?

Yes, until the next major update is announced.

Also Read

Conclusion: Embrace the New Union Territory GST Code

The union territory GST system has become more transparent, simple, and reliable thanks to the 2025 update. With the GST UT code 2025, invoicing for UTs has become clearer, tax calculations are easier with tools like Easy GST Calculator, and businesses can now stay fully compliant with new rules.

As India continues to evolve its taxation structure, staying updated and informed will help all citizens, entrepreneurs, and professionals benefit from these policy changes. Make sure your systems are ready, and your knowledge is current with the GST changes India introduced in 2025.

Dear Sir/ma,

We are a financial services and advisory company, and our investors have mandated us to seek business opportunities and projects for potential funding and debt capital financing.

Please note that our investors are based in the Gulf region and are interested in investing in viable business ventures or projects that you are currently executing or plan to undertake as a means of expanding your global portfolio.

We are eager to have more discussions on this subject in any way you believe suitable.

Please get in touch with me on my direct email: michaelanthony@capitalltduk.com

Looking forward to working with you.

Yours faithfully,

Michael Anthony

(Financial Advisor)

Capital Ltd Consulting LLC